A Northern Territory land council boss is accused of misusing Indigenous royalties by funnelling millions of dollars into his own mining venture, while locals live in poverty.

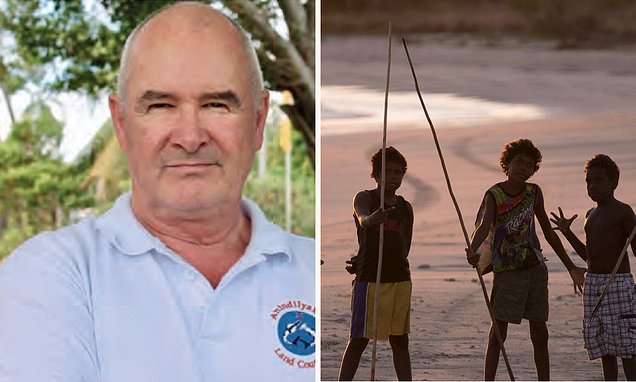

Mark Hewitt is the chief executive of Anindilyakwa Land Council, which is responsible for managing the royalties of the world’s largest manganese mine on Groote Eylandt, found offshore, but still part of the NT.

The n National Audit Office found $24 million, or 50 per cent, of the 2021/22 mining royalties were invested into Winchelsea Mining – co-owned and operated by Mr Hewitt.

Anindilyakwa Land Council CEO Mark Hewitt will face Senate estimates in Canberra

The money was funnelled through other organisations, including the Groote Holdings Aboriginal Corporation (GHAC) and the Anindilyakwa Advancement Aboriginal Corporation (AAAC), according to the audit office.

As part of the May 2023 report, auditors made 15 recommendations, 14 of which were agreed to by the council.

Since then, the council claims to have adopted the majority of recommendations, most of which it describes as ‘administrative and procedural in nature’.

‘We have implemented the recommendation to assess whether management plans for the chair’s and CEO’s interests in Winchelsea Mining and Groote Holdings Aboriginal Corporation are effective,’ Mr Hewitt told AAP in a statement.

Land council chair, Tony Wurramarrba, and Mr Hewitt are co-directors of Winchelsea.

Mr Hewitt’s wife is also the land council’s major investment and development co-ordinator, chief operations officer of GHAC, and chief executive assistant of Winchelsea.

‘The risk of conflicts of interest is high,’ auditors found, citing a mix of chair and CEO influence on council funding and management, plus direct and spousal positions in GHAC and Winchelsea Mining.

‘The current management strategies applied to this risk are either insufficient or not implemented.’

The audit also found the council finance committee approved 99 per cent of the funding requests from Mr Hewitt, compared with 53 per cent of other requests.

‘The (audit) observed disproportionate benefit to the entities with which the CEO is associated,’ the report reads.

The Centre for Public Integrity’s Geoffrey Watson said the findings of the audit must be referred to the National Anti-Corruption Commission.

‘To see that land council royalties have been misused in the way identified by the audit is heartbreaking,’ he told AAP.

‘The conflict of interest is not going to be managed if the people are still in those positions, and the same exorbitant funds are being paid to corporate entities associated with people closely connected with the management of the land council.’

He is confused why a ‘serious’ audit such as this had not received greater publicity.

‘It’s so bad and so wrong, it needs urgent referral to the NACC,’ he said.

In one instance, Mr Hewitt applied for funding on behalf of the AAAC, which is supposed to be a solely Indigenous corporation.

The land council boss is accused of misusing Indigenous royalties by funnelling millions of dollars into his own mining venture, while locals live in poverty.

‘There was no clear reason for the ALC CEO being the applicant on behalf of AAAC, since (he) holds no formal position in AAAC (although he is co-CEO and director of Winchelsea Mining, which is a subsidiary of AAAC),’ the report says.

The finance committee meetings, designed to decide where royalties are directed, are held in Darwin or Cairns and are all attended by Mr Hewitt.

Groote-based Aboriginal corporations do not have the opportunity to present funding applications in person, the report found.

The land council’s own internal audit committee was also found to have conflicts of interest.

Mr Hewitt said the council was working to ensure the council audit committee chair was ‘independent and undertaking all mandatory functions’.

Council audit committee chair Mark O’Shea is the founder of Enmark consulting, to which the council paid $896,056 in consultancy fees between 2014/15 and 2021/22.

The committee charter requires each member to provide annual declarations of ‘any material or personal interests that would preclude them from being members’.

The chair and other members have never made a declaration.

Mr O’Shea remains the council audit committee chair.

Royalties for the Anindilyakwa people have ranged from $15.1 million in 2016/17 to $86.0 million in 2018/19.

Though the island is rich in manganese, the majority of the 1500 Indigenous residents still live in abject poverty.

Almost 50 per cent of locals left school before year nine and less than half have full-time employment, according to the n Bureau of Statistics.

Life expectancy rates are low and almost half of the houses are overcrowded.

People living on the island told AAP royalties would be better served improving health, housing and educational outcomes.

‘There’s so much money from the mine, everyone should be living in a mansion here,’ one person said.

South 32’s GEMCO mine on Groote Eylandt is due to close in 2032 after 65 years in operation. Winchelsea Mining plans to invest in continued manganese mining on a small nearby island, but there are doubts that the mineral deposit at the site would make that a viable operation.

Federal Minister for Indigenous Affairs Linda Burney said she would continue working with the ALC to ensure recommendations are implemented.

The ALC will front a federal parliamentary hearing on Friday.