ns’ standard of living is stalling, according to one of ‘s leading economists, who shared new data showing the country has fallen behind other developed nations in a key economic area the last 12 months.

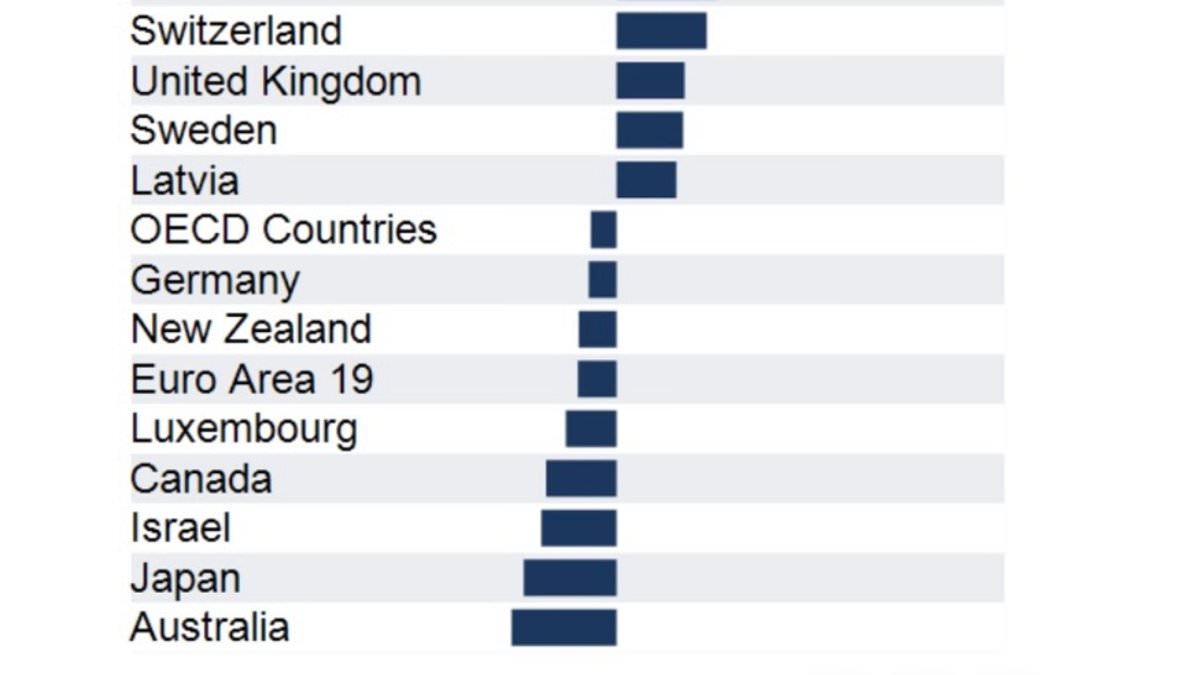

AMP’s chief economist Shane Oliver shared a graph to social media on Friday showing the labour productivity change for more than 17 other comparable economies over the last year – with ranked at the bottom.

According to Mr Oliver’s data, ‘s labour productivity – which is a generalised measure of how much product is produced per hour of work – has fallen by more than 1 per cent in 2024.

Other countries such as the US and Norway had positive growth in labour productivity at around 2 per cent, while Poland topped the list with a 5 per cent increase.

Labour productivity can be used as one indicator for the standard of living in a country as a higher output generally means workers are paid more and more is produced, making items cheaper.

‘n labour productivity growth running at the bottom of the OECD … it’s the basic reason why living standards are falling in ,’ Mr Oliver said.

The economist said an increase in government spending was fueling the nation’s decline in productivity because as it did less to encourage private enterprise.

‘The surge in public spending is exacerbating ‘s productivity slump with productivity down another 0.8 per cent over the last year as private market sector productivity is invariably higher than public sector productivity and as public spending squeezes out private business investment, it is likely exacerbating the weakness in private market sector productivity,’ he explained.

Mr Oliver said weak productivity growth made it harder to tame inflation and hinders long term growth in per capita GDP which in turn stalls living standards.

He added public spending was also making the RBA’s job harder as it had to keep interest rates higher for longer because there was still high demand from consumers.

The high interest rates were also ‘squeezing out’ private investment, he said.

‘Federal and state governments need to slow their spending to stop squeezing out private spending and do more to fundamentally boost productivity, which requires tax reform, labour market deregulation, competition reforms,’ he said.

He said governments working with the RBA to reduce spending and tame inflation was made harder with a looming federal election and both political parties out to win votes.

‘s economy is still growing – but only just – though economists are unconvinced the weaker-than-expected data will bring forward keenly-anticipated interest rate cuts.

Full-year growth fell to 0.8 per cent in September, down from one per cent in June and below the 1.1 per cent consensus forecast.

n Bureau of Statistics head of national accounts Katherine Keenan said the nation’s economy grew for the 12th consecutive quarter but has been slowing since September 2023.

Viewed quarterly, the bureau recorded a minor improvement, with the economy growing 0.3 per cent in the September quarter, up from 0.2 per cent in the three months to June.

Governments were once again big contributors to economic activity, with defence spending behind a sizeable 5.3 per cent lift in public investment over the quarter.

Moody’s Analytics head of China and economics Harry Murphy Cruise said cost-of-living measures such as energy bill relief took a chunk of what would usually be considered household spending and put it on governments’ books.

‘That switcheroo, combined with tax cuts, freed up finances that could have been used on other goods and services,’ he said on Wednesday.

But households didn’t go on a spending spree – instead choosing to build up savings buffers and pay down mortgages.

‘That kept household spending flat through the September quarter and pushed the household saving ratio to its highest since the end of 2022,’ Mr Murphy Cruise said.

With the Reserve Bank of trying to engineer a slower economy to curb inflation by keeping interest rates elevated, the level of government spending has become a source of debate.

Though some economists argue public spending is keeping out of recession, others warn it’s contributing to inflationary pressures and keeping interest rates higher for longer.