Jeremy Hunt will slash National Insurance by another 2p today in a tax-cutting drive ahead of the next election.

Whitehall sources told the Mail the Chancellor will press ahead with a second consecutive 2p cut in personal tax today, leaving the average worker £900 a year better off.

Mr Hunt and Rishi Sunak hope the move will help persuade voters that the Conservatives are serious about cutting a tax burden which has risen to record levels in the wake of the pandemic and energy crisis.

Some Tory MPs last night warned that a bigger package was needed, including a reduction in income tax. But Whitehall sources said that tight public finances had made it impossible to ‘responsibly’ offer bigger tax cuts.

Mr Hunt will today stress that his Budget package is fully funded, allowing him to make the reductions ‘permanent’. And he will hint at further tax cuts to come, possibly in a second Budget ahead of an autumn election.

However, the possibility of a National Insurance cut has also sparked talk of a General Election in May.

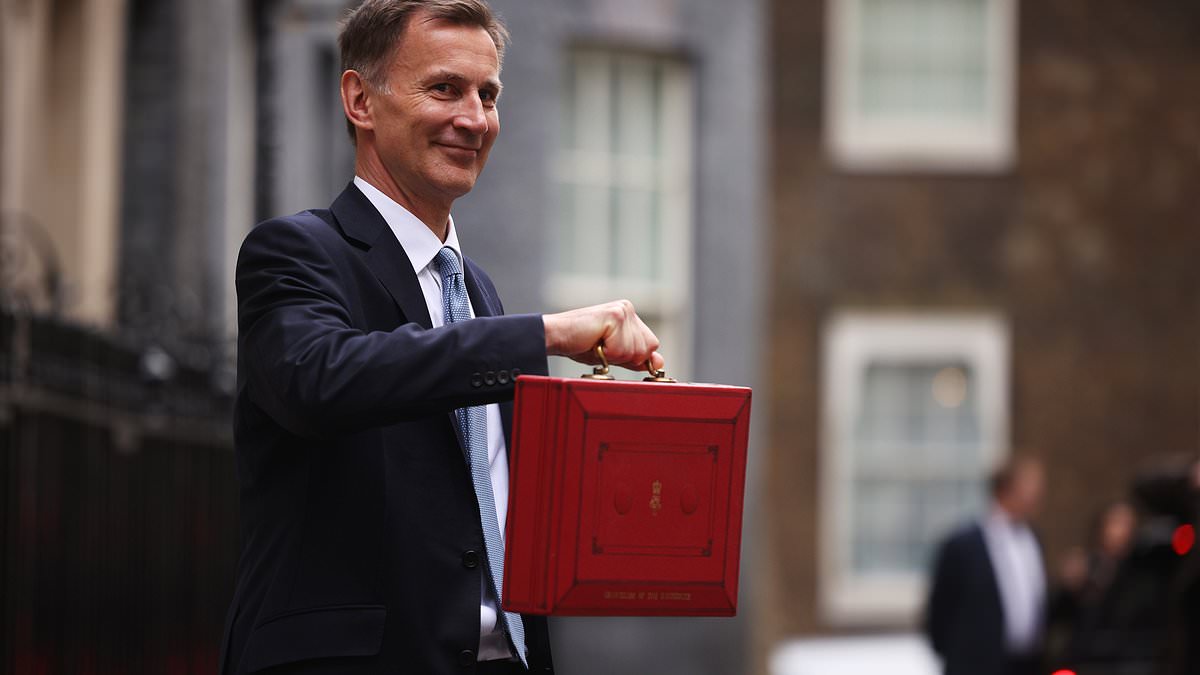

Jeremy Hunt (pictured) will slash National Insurance by another 2p today in a tax-cutting drive ahead of the next election

King Charles III meets with Chancellor of the Exchequer Jeremy Hunt in the private audience room at Buckingham Palace, London, on March 5

Mr Sunak is also preparing to offer further tax cuts in the election campaign, and is considering reviving a previous pledge to knock 4p off income tax by the end of the decade.

One senior Tory said the PM viewed today’s Budget as a vital stepping stone in reviving the Tories’ economic credibility. ‘On tax, he believes we need to show, not tell,’ the source said.

Signalling further tax cuts to come, Mr Hunt will say: ‘Because of the progress we’ve made because we are delivering on the Prime Minister’s economic priorities we can now help families with permanent cuts in taxation.

‘We do this not just to give help where it is needed in challenging times. But because Conservatives know lower tax means higher growth. And higher growth means more opportunity and more prosperity.’

In what is set to be a key election battleground, the Chancellor will also contrast his approach with Labour’s warning that the opposition would ‘risk family finances with new spending that pushes up tax’.

Labour claimed that today’s Budget was designed to clear the way for a May election.

Economic think-tanks warned the NI cut would not be enough to prevent the overall tax burden rising as a result of huge stealth taxes imposed in the wake of the pandemic.

The Institute for Fiscal Studies said: ‘Based on forecasts from last autumn, that tax cut would not – by itself – be enough to prevent taxes as a share of GDP from rising to record levels in 2028-29.’

The Resolution Foundation said that people on less than £19,000 a year would be left worse off overall, as the impact of frozen tax thresholds on their income would be greater than the benefit of the cut in NI.

Today’s cut will cost £10billion and benefit 27million workers. The standard rate, which was 12p before November’s autumn statement, has already been cut to 10p and will now fall to 8p next month.

Mr Hunt and Rishi Sunak (left) hope the move will help persuade voters that the Conservatives are serious about cutting a tax burden which has risen to record levels in the wake of the pandemic and energy crisis

Former Cabinet minister Priti Patel (pictured) last night said a cut in income tax would have been a better way to ‘show that we back working households’

A worker on an average earnings of £35,000 will gain £450 a year. But because the Chancellor cut National Insurance by an identical sum in November, he will present it as a package worth £900 to the average worker.

People earning more than £50,000 a year will gain almost £1,500 a year from the two tax cuts. The Chancellor is expected to introduce a comparable package for the self-employed as he did in the autumn.

But pensioners will miss out because they do not pay National Insurance. Dennis Reed, of the campaign group Silver Voices, said pensioners would be ‘bitterly disappointed’ if they miss out again, particularly as a growing number are being dragged into the tax system by the six-year freeze in thresholds.

Former Cabinet minister Priti Patel last night said a cut in income tax would have been a better way to ‘show that we back working households’.

Mr Sunak had pushed to introduce a 2p cut in income tax instead, which would have benefited more people, including pensioners, But the plan was dropped after the Office for Budget Responsibility warned the £14billion price tag was ‘unaffordable’.

The OBR’s ruling has triggered a scramble for cash at the Treasury as the PM and Chancellor try to identify the money needed to pay for today’s tax giveaway.

Mr Hunt has been weighing up a squeeze on post-election public spending which could yield up to £5 billion, and will warn today that the public sector needs to be ‘more productive’.

He is also planning a string of smaller tax rises. The Chancellor hopes to generate £2billion by curbing tax breaks for wealthy non-doms. Extending the windfall tax on North Sea oil and gas could raise another £1billion.

A new tax on vaping, coupled with higher taxes on smoking will raise a further £500million. And the Chancellor is expected to raise hundreds of millions more by hiking air passenger duty on business flights and cutting tax breaks for landlords.

But tight public finances mean there will be no new money for defence, despite rising threats from Russia and growing tensions in the Middle East.

Former Tory minister Sir John Redwood suggested the Chancellor should have been bolder, saying: ‘We want a tax cutting Budget and you don’t really create a tax cutting Budget if you begin by creating new taxes.’

But Mr Hunt will today say that he also has a duty to cut public debt.