Ultra-wealthy Americans are rushing to open Swiss bank accounts amid fears of economic turmoil and concerns their cash will be targeted by Donald Trump.

Increasing uncertainty and fears of potential restrictions on moving money overseas mean the rich are transferring hundreds of millions of dollars out of the US.

Robert Paul, co-head of private clients at UK-based wealth management firm London and Capital, told The Telegraph: ‘These are big chunks of money. We’ve had five cases in the last three or four weeks, and the sums have been $40m, $30m, $30m, $100m and $50m.’

He added: ‘I am expecting to have at least this again if not more.’

Paul told the outlet his clients are taking money out of US brokerage accounts and opening accounts in Switzerland and the Channel Islands of Jersey and Guernsey.

Ollie Marshall, director of UK-based property buying consultancy Prime Purchase, told The Telegraph that he thought it was mainly Democratic Party sponsors worried about some form of financial retribution.

‘Of course, there’s no proof the administration is actively targeting them yet, but the government’s policies are so extreme they could be right to be worried about it.’

Josh Matthews, co-founder of Maseco, which provides wealth management for Americans abroad, said that the last time he had seen this type of interest was during the financial crisis when wealthy Americans feared US bank failures.

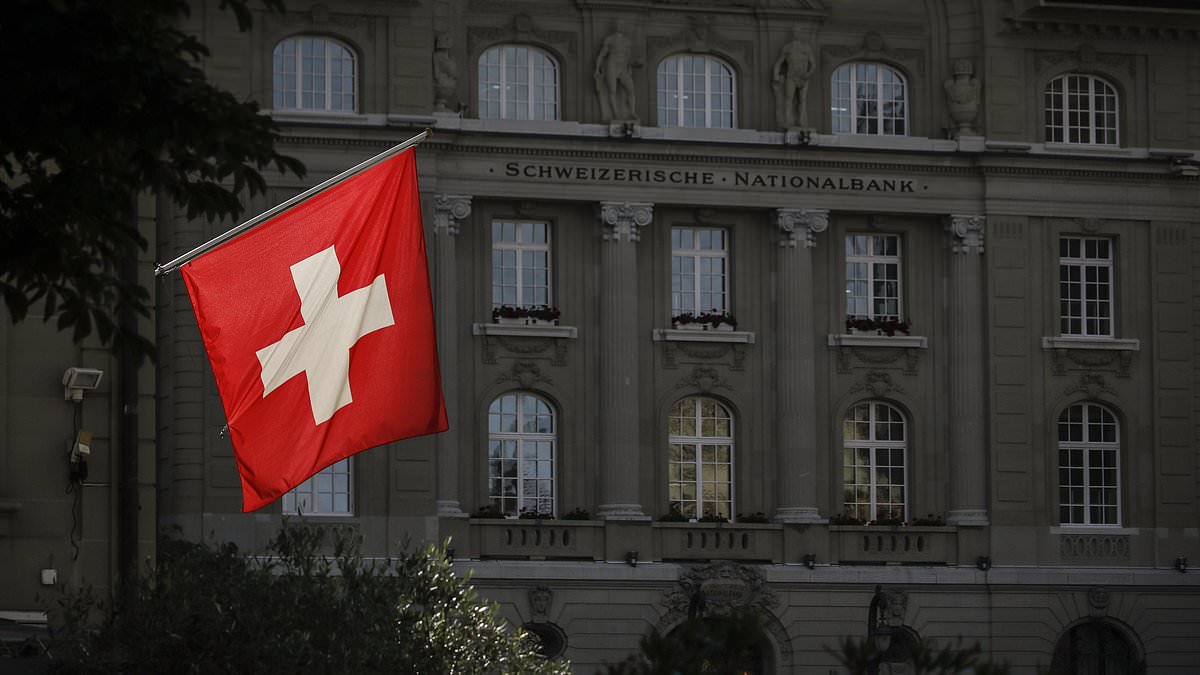

Ultra-wealthy Americans are rushing to open Swiss bank accounts amid fears their cash will be targeted by Donald Trump

It is happening now, he told The Financial Times, because of ‘the uncertainty of a Trump presidency.’

The Trump administration has proposed widespread tariffs on key trading partners, which has caused turmoil in the stock market and sparked concern from many business leaders.

Paul told The Telegraph that the wealthiest Americans are keen to have some money which is not located inside the US.

‘There has been fear around capital controls and movement of money. Why it’s heightened in the past four weeks is because the rhetoric is chopping and changing pretty quickly.

‘A lot of this is discussions around dinner parties of the ultra-wealthy,’ he told the outlet.

Capital controls are measures taken by a government to regulate the flow of money into and out of a country.

While Trump has not directly discussed imposing these measures, investors are concerned by the volatility of his policy-making.

The President has made sudden alterations and delayed tariffs at the last minute on several occasions.

Judi Galst, the managing director of private clients at Henley & Partners in New York, said at least a quarter of her clients have inquired about moving money out of the country due to the new administration.

Robert Paul, co-head of private clients at UK-based wealth management firm London and Capital, said his clients are taking money out of US brokerage accounts and opening accounts in Switzerland and the Channel Islands of Jersey and Guernsey

The Trump administration has proposed widespread tariffs on key trading partners, which has caused turmoil in the stock market and sparked concern from many business leaders

Switzerland is the world’s top destination for cross-border wealth management, but Americans cannot simply open an account due to strict regulations

Read More

Worrying new 401(K) trend sets alarm bells ringing on state of US economy

‘I hear a lot about Switzerland and Liechtenstein. I talked to somebody at one Swiss bank who told me that they’d opened 12 accounts like this for Americans in the past two weeks,’ she told the outlet.

She said many rich Americans are worried it is not in their best interests to hold all their assets in the US due to the potential negative impact of tariffs and federal cuts on economic growth.

Pierre Gabris, founder and managing partner of Zurich-based Alpen Partners, told the Financial Times that he had seen a lot of inquiries.

‘Certainly that has been a pattern in the past few months,’ he said. ‘Since the election there have been some anti-Trump clients and many are driven by fear.’

Swiss private bank Pictet confirmed to the outlet that it had seen a ‘significant uptick’ in demand at its Swiss-based entity Pictet North America Advisors, which is registered with the Securities Exchange Commission (SEC).

Switzerland is the world’s top destination for cross-border wealth management, but Americans cannot simply open an account due to strict regulations.

But if a Swiss wealth manager is registered with the SEC in the US then it can help clients open accounts and manage their money overseas.

It comes after billionaires Jamie Dimon and Larry Fink have both begun to express their concern about the impact of Trump’s policies on the US economy.

JPMorgan Chase CEO Dimon warned earlier this month that the uncertainty around tariffs is ‘not a good thing’ for business.

Fellow billionaire Fink, who is CEO of investment management company BlackRock, also said this month that the volatility around the policy changes is already hurting the economy.