n home borrowers could get a rate cut soon with the Reserve Bank hinting relief was on the way with global financial markets worried about an American recession.

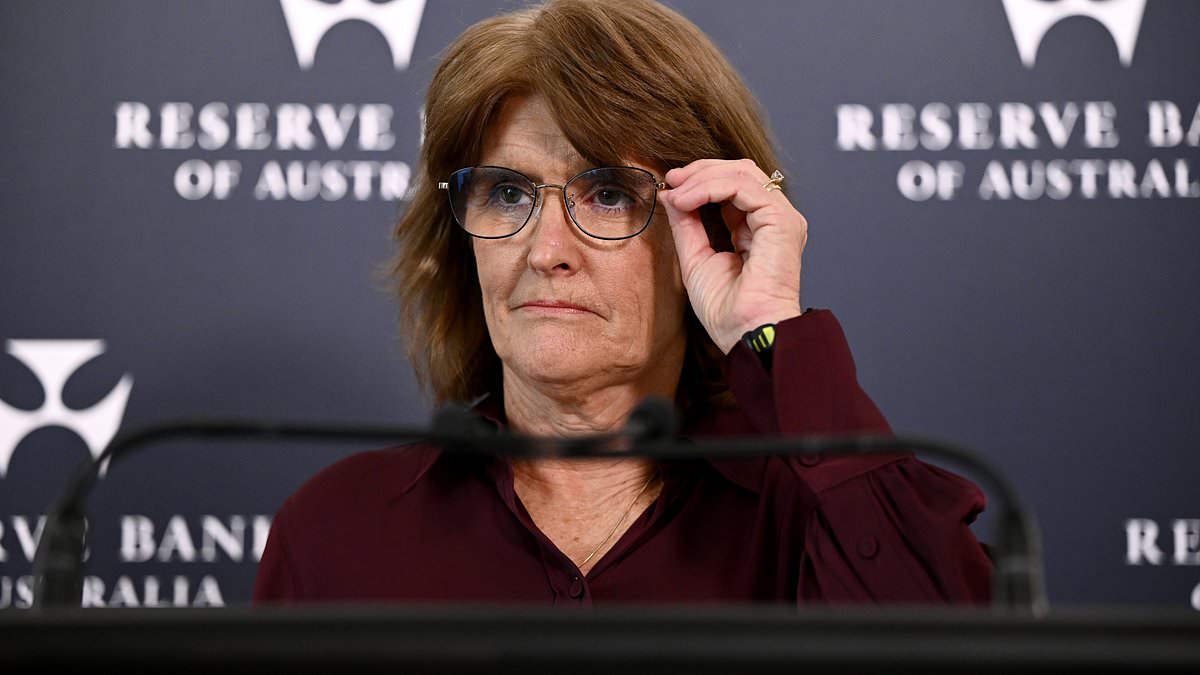

The cash rate was left on hold at a 12-year high of 4.35 per cent on Tuesday afternoon but Governor Michele Bullock has strongly hinted the next move was more likely to be an easing despite n inflation still being on the high side.

‘Momentum in economic activity has been weak, as evidenced by slow growth in GDP, a rise in the unemployment rate and reports that many businesses are under pressure,’ the Reserve Bank said.

The focus on record business insolvencies marked a dramatic change from the June meeting when Ms Bullock told reporters the board had considered a rate rise but not a rate cut.

Instead, the RBA is now focused on slow gross domestic product or GDP growth.

The Reserve Bank said overseas developments rather than local inflation were now more likely to influence its next rates decision, following its latest two-day meeting.

‘The board will rely upon the data and the evolving assessment of risks to guide its decisions,’ it said.

‘In doing so, it will continue to pay close attention to developments in the global economy and financial markets, trends in domestic demand, and the outlook for inflation and the labour market.’

Financial markets are now expecting the Reserve Bank to cut rates in late 2024 even though inflation in the year to June edged up to 3.8 per cent – putting it further above the Reserve Bank’s 2 to 3 per cent target.

Fears of an American recession saw more than $100billion wiped off the n share market on Friday and Monday – marking the worst two-day fall since the start of the pandemic in March 2020.

The 30-day interbank futures market is now forecasting rate cuts in November and December – marking the first back-to-back rate cuts since the pandemic in early 2020.

The US Federal Reserve is now widely expected to cut interest rates three times in 2024, with rate cuts already occurring this year in the European Union, Canada and the UK.

Capital.com market analyst Kyle Rodda said the futures market was no longer expecting another n rate hike, despite inflation still being on the high side.

‘No one is really talking about rate hikes anymore and there are international issues that are driving that but there’s also the fact that local inflation data’s not as bad as previously thought,’ he told Daily Mail .

‘Increasingly, markets believe a hike can be taken off the table despite the fact inflation remains above target in .’

AMP chief economist Shane Oliver said the Reserve Bank risked sparking a recession in if it took too long to start cutting rates, echoing fears about the American economy.

‘While the RBA still faces inflation that’s too high, given the US experience it should now be giving consideration to a cut in interest rates as it now risks much higher unemployment and inflation falling below target,’ he said.

This is despite the Reserve Bank continuing to warn of high inflation in its August statement.

‘Data have reinforced the need to remain vigilant to upside risks to inflation and the board is not ruling anything in or out,’ it said.

‘Policy will need to be sufficiently restrictive until the board is confident that inflation is moving sustainably towards the target range.’

The RBA still has a neutral monetary policy stance, given it has retained the phrase about it ‘not ruling anything in or out’.

This means a rate hike is still a possibility, even if it’s a remote one.

Two rate cuts in 2024, as the futures market is predicting, would take the Reserve Bank cash rate back to 3.85 per cent by Christmas for the first time since June 2023.

Monthly repayments on an average $600,000 mortgage would fall by $197, back to $3,671 as a Commonwealth Bank variable rate fell to 6.2 per cent.