A car dealership charging a handling fee for cash transactions has sparked outrage for drivers despite the fee being completely legal.

Peter visited Sydney City MG in inner-city Alexandria, when he saw a sign in the showroom laying out the surcharges for different forms of payment.

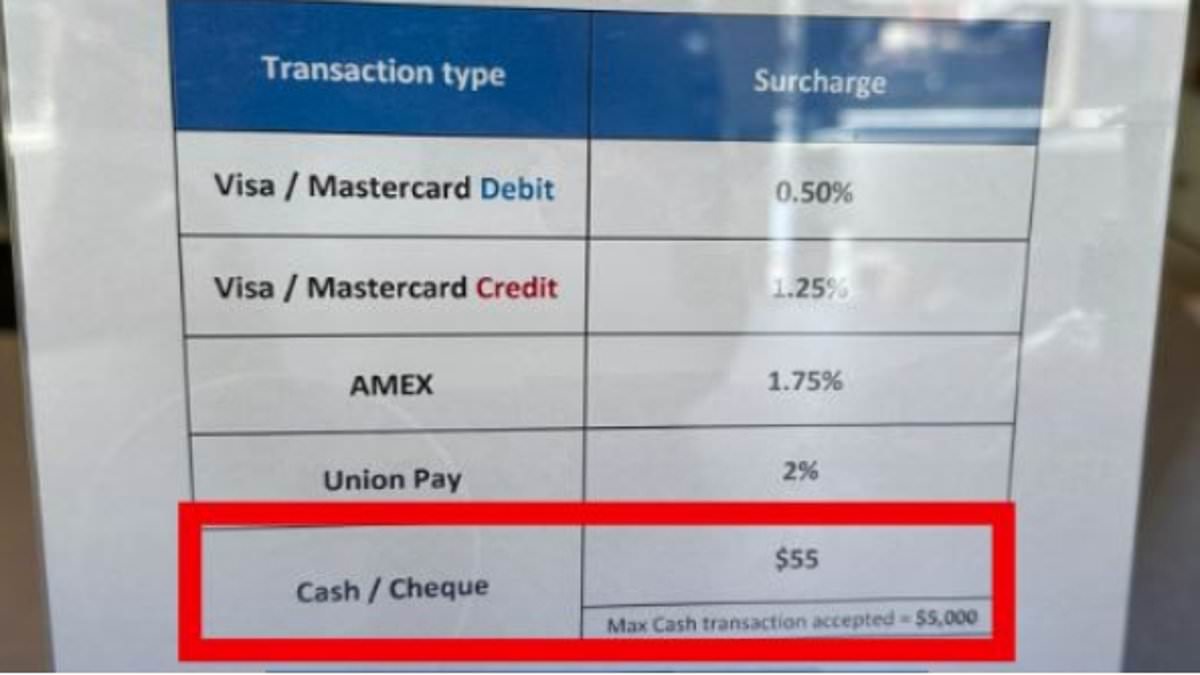

The sign indicated anyone paying with cash or cheque would be lumped with a $55 surcharge for the transaction.

Whereas surcharges for Visas and AMEX are percentages of the entire fee, the handling fee for any cash payment was locked at $55 regardless of the amount spent.

Although Peter did not buy a car in the dealership, he snapped an image before sharing it with 2GB’s Chris O’Keefe.

The Australian Competition & Consumer Commission (ACCC), meanwhile, says the dealer’s charge is perfectly legal.

Sydney City MG has sparked outrage for their unprecedented cash payment surcharge, which the ACCC says it perfectly legal since it is not misleading consumers

Historically, cash payments have been a way to avoid a surcharge on large transactions and Peter said that he had never seen one like this before.

‘If you’re going to go in there with cash, you’re going to do a bargain and you’re going to want a discount anyway for cash because it’s legal tender, there’s no fees,’ he told O’Keefe.

‘And then they slug you with that? It’s an insult in any transaction.’

A 0.5 per cent surcharge is listed for Mastercard debit cards, 1.25 per cent for Mastercard credit cards, 1.75 per cent for American Express and 2 per cent for Union Pay.

The maximum cash transaction allowed at the dealership is $5,000, which works out to be a 1.1 per cent surcharge and a worse deal than using a debit card.

The dealership offers services as well as selling cars, which means that a basic service could incur a 24.3 per cent surcharge if paid for with cash

Sydney City MG also services cars with the average basic service costing $226, according to car insurer Canstar.

This means a basic service would rack up a 24.3 per cent surcharge if paid for in cash.

Mr O’Keefe reached out to the ACCC who told him that there was no law that could prevent businesses from adding the surcharge.

‘There is nothing in the (legislation), or the Australian consumer law, that stops a business from adding a surcharge to a cash payment,’ the corporate watchdog said.

It added that there are extensive laws about misleading prices, but there was nothing misleading about the signage clearly stating the flat rate surcharge.

Peter said that he would never use cash to buy a car if he was charged for doing so.

‘They’re abusing what they can to make some extra money on the side,’ Mr O’Keefe said.

Daily Mail Australia has contacted Sydney City MG for comment.