Nearly everything on Wall Street is tumbling Monday as fear about a slowing US economy worsens and sets off another sell-off for financial markets around the world.

The S&P 500 was down by 4 percent in early trading, coming off its worst week in more than three months. The Nasdaq was down 6 percent to pull it 15 percent below its record set last month.

JPMorgan, the world’s biggest bank, now says the chances of a recession are at 50 percent.

12:24

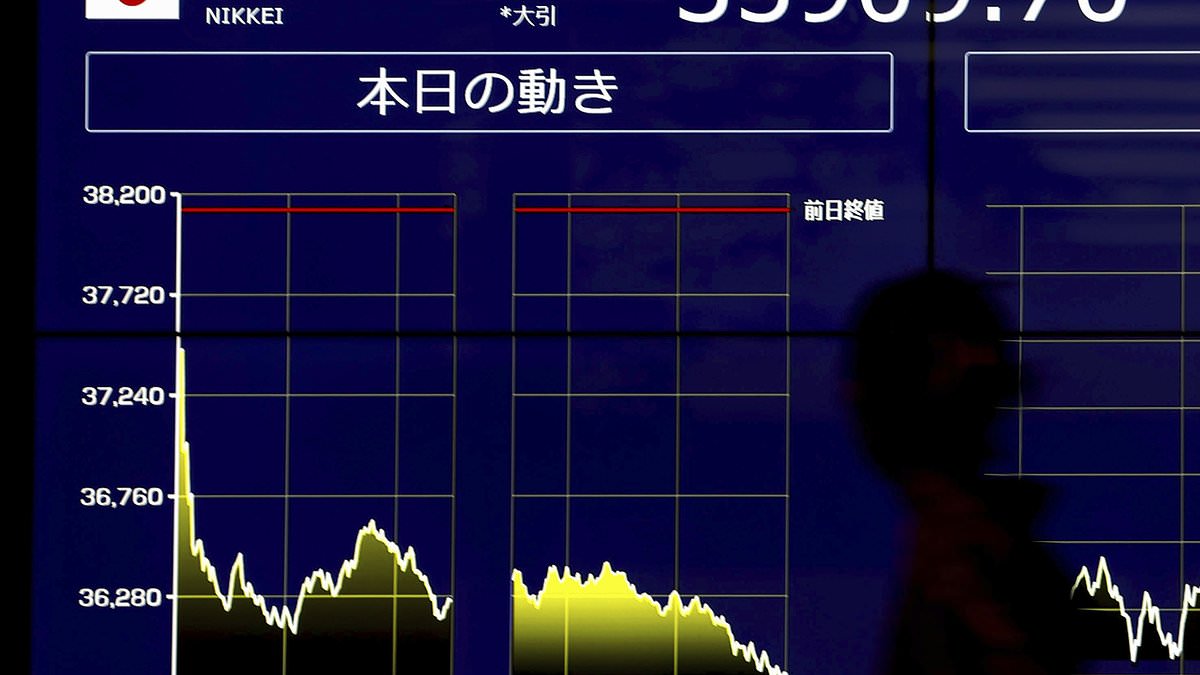

Fears US is heading for recession triggers global stock market plunge with Japan's Nikkei experiencing worst sell-off since 'Black Monday

14:01

Major bank stocks fall into the red

14:00

Stock trading platforms reported as down

13:45

Magnificent Seven takes biggest hit on record

13:35

Almost all stocks were red at the market open in New York – and Nasdaq index down a huge 6 percent

13:29

US investors are bracing for the stock market to open at 9.30am New York time – with fears the sell-off will intensify as 'fear gauge' sees biggest daily jump

13:17

Fears of a trading circuit breaker rise as stocks set to tumble

13:09

AI darling on track for biggest ever loss in value in a day

12:56

US stocks are plunging in pre-market trading -with the S&P 500, the benchmark US index, set for biggest opening drop in four years

12:24

Top economist issues dire warning about the US economy as he tears into the Fed for huge 'policy blunder' that could send country spiraling into RECESSION: 'I really do worry'

Key Updates

-

Fears US is heading for recession triggers global stock market plunge with Japan's Nikkei experiencing worst sell-off since 'Black Monday