Ministers are ready to bring back a Covid-style furlough scheme to save thousands of jobs at risk if Donald Trump’s global trade war escalates.

Downing Street has lined up measures to shield key sectors including the car industry that have been hardest hit by the US President’s sweeping tariffs, now at their highest level since the 1890s.

Yesterday Parliament was recalled on a Saturday for only the second time since the Falklands War to approve plans to aid loss-making British Steel.

The Government also announced a package that gives UK Export Finance the power to expand financing support for British businesses by £20 billion.

It also said small businesses would be able to access loans of up to £2 million through the British Business Bank’s Growth Guarantee Scheme.

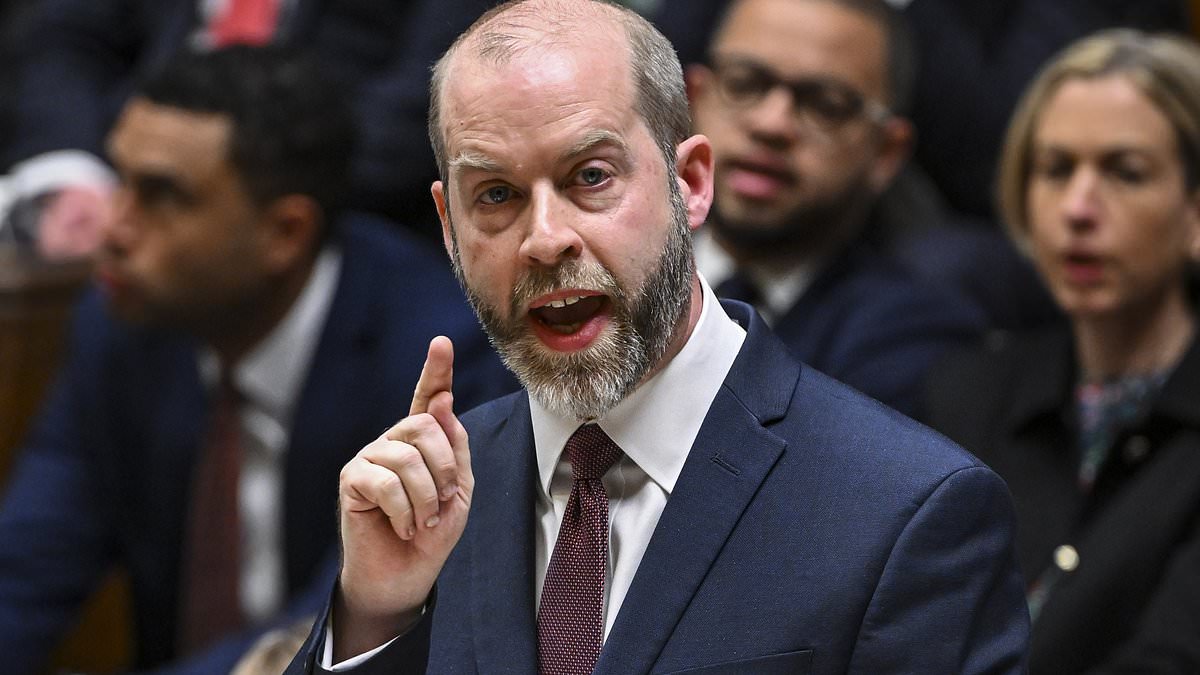

Business and Trade Secretary Jonathan Reynolds said: ‘Our message to British business is clear – we’ve got your back.

‘This package, backed by the British Business Bank and UKEF, will be a crucial shot in the arm to exporters and small firms looking to trade around the world.’

Experts say further state intervention is likely to prop up tariff-hit firms and protect up to 100,000 jobs under threat from a protracted trade war between the US and China, the world’s biggest economies.

Prime Minister Keir Sir Keir Starmer has said he is ‘ready to use industrial policy to help shelter British businesses from the storm’, while Mr Reynolds told MPs he was ‘keeping all options on the table’.

As well as loans and grants to businesses and households – as happened during the pandemic five years ago, Government action could involve reviving a less ambitious version of the Coronavirus Job Retention Scheme, which cost taxpayers £70billion.

That programme gave grants to employers to pay 80pc of staff wages and employment costs, up to £2,500 each month.

Other options from the Covid era include re-introducing an income support scheme for the self-employed and increasing universal credit payments and working tax credits.

Such support would be ‘the final line of defence in cushioning (the UK) against any negative economic shock’ if unemployment unexpectedly spiked, said Deutsche Bank economist Sanjay Raja.

As well as via the British Business Bank, grants and loans could be administered by the National Wealth Fun and ‘potentially’ the Bank of England, costing between £5billion-£10billion, he added.

A package of that size would blow a hole in Rachel Reeves’ ‘non-negotiable’ fiscal rules and raise the prospect of more tax rises to balance the books.

The Chancellor left herself just £9.9billion of ‘headroom’ in last month’s Spring Statement to meet her target of debt falling as a share of national output within five years.

‘She’s going to have to have all options on the table, including re-visiting her promise not to touch income taxes or VAT,’ warned Mohamed El-Erian, chief economic adviser at insurer Allianz.

Reeves’ room for manoeuvre is already under threat after Government borrowing costs soared last week to the highest level since 1998 as Trump slapped a blanket 10pc tariff on all goods entering the US, including UK exports.

Trump also imposed a 25pc levy on car, steel and aluminium imports, and a 145pc tariff on goods from China, who retaliated in kind, sparking more turmoil on global stock markets.

The tariffs shock comes as business reels from the £25billion National Insurance tax that came in to force last week.

Despite better-than-expected growth figures on Friday, the UK is expected to take a big hit from all-out trade war between the US and China.

Sarah Breeden, a top Bank of England official, warned tariffs would have ‘chilling effect’ on UK growth.

Trump has suspended imposing most of the levies for 90 days while bilateral trade deals with dozens of countries hit by enhanced tariffs are negotiated.

Tariffs are expected to plunge the US into recession later this year as the price of imports soars and demand for items such as imported iPhones, cars and sneakers shrinks.

‘It’s clear the US economy hasn’t seen a shock like this since the 1920s and 1930s,’ said Tiffany Wilding, chief economist at PIMCO, which manages $2trillion (£1.5trilion) of assets.

A Downing Street spokesperson said: ‘A trade war is in nobody’s interest. We don’t want any tariffs at all, so for jobs and livelihoods across the UK we will coolly and calmly continue to negotiate in Britain’s interests.’