A number of major banking groups have announced they will close another 53 high street bank branches this year, marking yet another blow to customers who rely on face-to-faces services.

In January, it was revealed that nearly 200 bank branches are already set to close this year as lenders continue withdrawing from the High Street.

Nearly 6,000 outlets have disappeared since the start of 2015 as banks continue to cut costs and point to the growing shift by customers towards using online services.

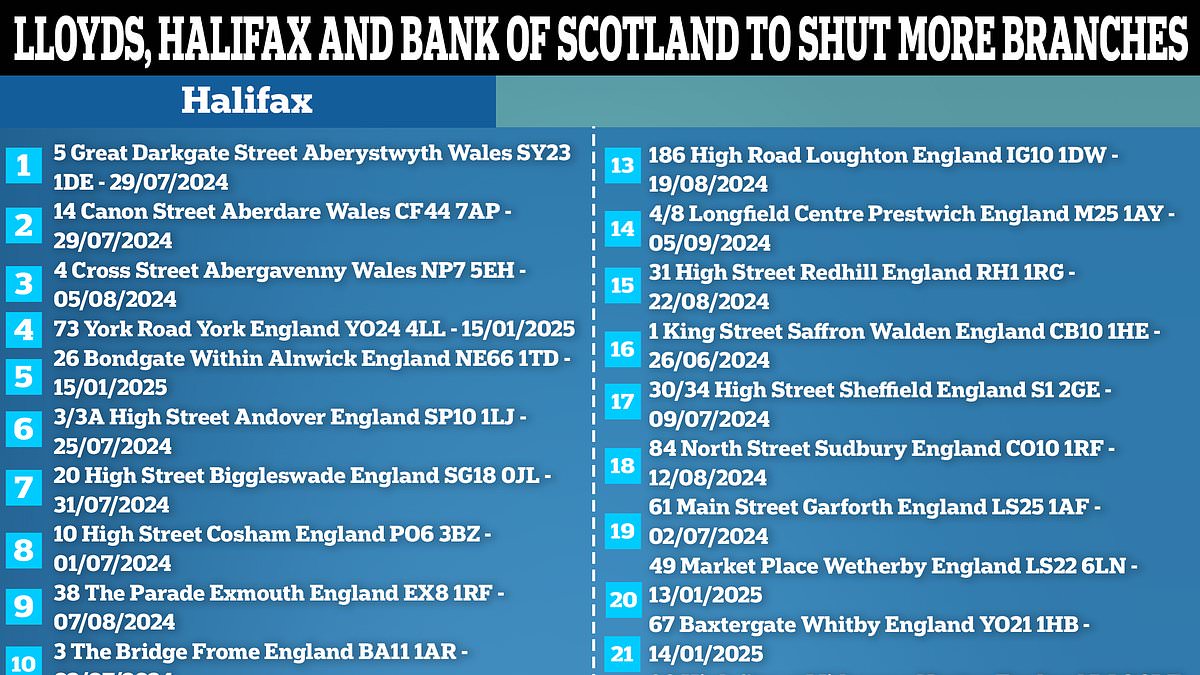

Lloyds have now confirmed that they are to close a further 21 branches, Halifax will be closing 22 sites and Bank of Scotland (BoS0) will be shuttering 10.

The areas to be most affected by the closures include high streets in Scotland, Wales and parts of England.

A number of major banking groups have announced they will close another 53 high street bank branches this year, marking yet another blow to customers who rely on face-to-faces services

If your local branch is set to close, or has recently, there are alternative options offered to those who still require face-to-face services.

If you’re a Lloyds or Bank of Scotland customer, you can check if a “mobile branch” service is available near you.

These are normally set up on specific dates and times each month, however, this service is only available until May 2024 and does not offer cash or counter services.

Many banks already offer a mobile banking service – where they bring a bus to your area offering services you can usually get at a physical branch.

Customers will also be advised to check if a “banking hub” is open in their area where a “community banker” can help with particular services.

Banking hubs are located in shared public buildings on the high street, such as libraries or village halls, for customers who need face-to-face support.

Each bank will take it in turns on a different day to occupy the “banking hub” space, but you don’t necessarily need to be a customer of that particular bank to use some of the services.

Lloyds, Halifax and Bank of Scotland customers are also able to carry out most basic banking tasks at your nearest Post Office.

Lloyds have now confirmed that they are to close a further 21 branches, Halifax will be closing 22 sites and Bank of Scotland (BoS0) will be shuttering 10

In January, it was revealed that nearly 200 bank branches are already set to close this year as lenders continue withdrawing from the High Street

The news comes after the retreat of banks from the high street has been laid bare by plans for a town to be left without a single branch.

Barclays is currently the only bank in Leiston, Suffolk, but its customers will soon have a near 50-mile round trip to their nearest branch after it revealed the outlet will close in May.

The return journey to Lowestoft, 24 miles away – will take at least 90 minutes by car, while accessing services in Ipswich, 26 miles away, will swallow up nearly two hours.

The Mail has repeatedly highlighted bank closures, while sister paper The Mail on Sunday has campaigned for communities to keep at least one bank in its Keep our Cash Manifesto.

Critics say businesses and charities that rely on cash then suffer, while people unable to go online are penalised.