Bipartisan tax negotiators have reached an agreement on a deal that would bring back popular tax breaks for businesses and expand the child tax credit.

The $78 billion compromise includes $33 billion for the child tax credit expansion and another $33 billion to bring back expired business breaks. It would offset that cost by reining in the Covid-era employee retention tax breaks.

Despite support from both parties, the deal will have an uphill battle to get through a fractured Congress. Tax writers hope to pass the deal before the filing season begins on January 29.

The blueprint brings back business deductions for domestic research and development and increases deduction for the purchase of machinery and equipment through 2025.

It also gradually raises the child tax credit to $2,000 and allows families who owe less than that on taxes to get it as a refund. It would allow families with multiple children to phase in for the credit faster and the tax credit would be adjusted each year for inflation.

Bipartisan tax negotiators have reached an agreement on a deal that would bring back popular tax breaks for businesses and expand the child tax credit

The deal would also expand the low-income housing tax credit to attract developers to build affordable rental units.

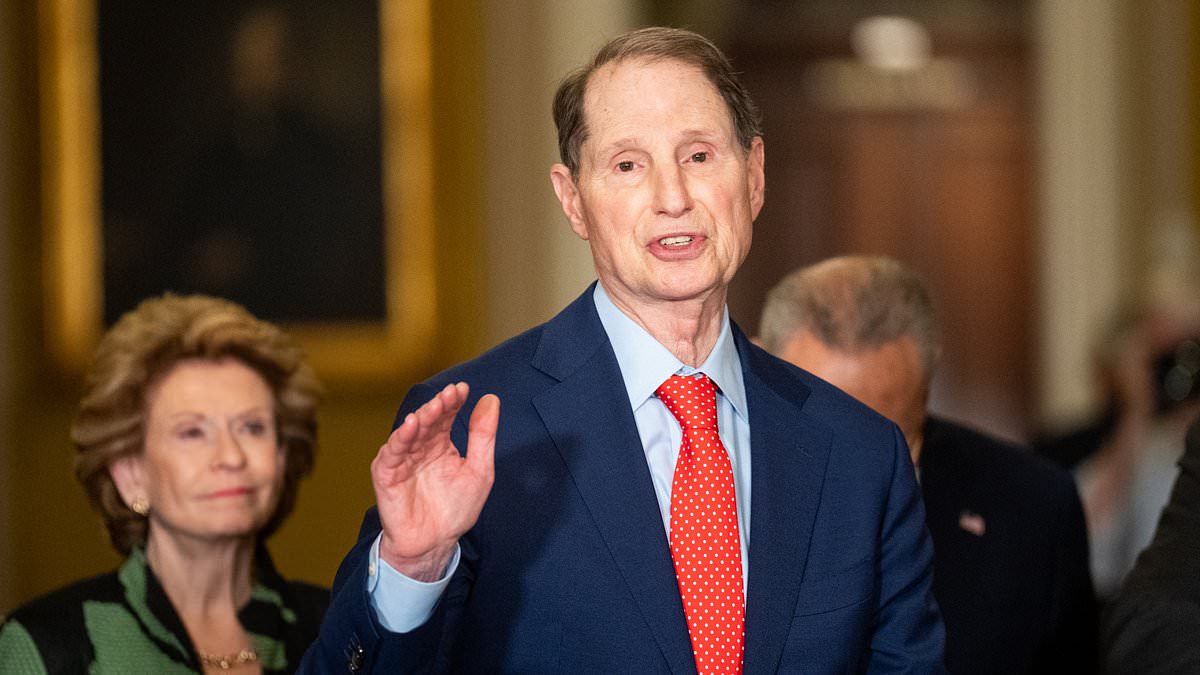

Top negotiator Ron Wyden, D-Ore., chair of the Senate Finance Committee, said those provisions would benefit 15 million kids from low-income families and help build some 200,000 affordable housing units.

The deal also offers disaster tax relief that would offer help to those affected by recent hurricanes, flooding, wildfires and even the East Palestine, Ohio train derailment – a provision that could attract hesitant members on both sides.

It would eliminate the Taiwan double taxation for businesses that have operations in both the U.S. and Taiwan.

To recoup costs of the relief provisions the deal would shorten the time period for when new claims can be filed for the Covid-era employee retention tax credit, which negotiators said is ripe for fraud. That currently offers employers a credit of up to 70 percent on an employee’s first $10,000 in wages for each quarter, or up to $28,000 a year.

‘My goal remains to get this passed in time for families and businesses to benefit in this upcoming tax filing season, and I’m going to pull out all the stops to get that done,’ Wyden said in a statement.

‘This legislation locks in over $600 billion in proven pro-growth, pro-America tax policies with key provisions that support over 21 million jobs. I look forward to working with my colleagues to pass this legislation,’ said Ways and Means Chairman Jason Smith, R-Mo., who negotiated the deal with Wyden.

Sidelined by the negotiations, however, were Rep. Richie Neal, Mass., top Democrat on the Ways and Means Committee and Sen. Mike Crapo, Idaho, top Republican on the Senate Finance Committee. Neither has endorsed the deal.

The package is sure to face long odds in a Congress that can’t even come to agreement on the basic yearly work of funding the government.

This week lawmakers will be focused on funding the government before a shutdown deadline on Friday, with Speaker Mike Johnson and Senate Majority Leader Chuck Schumer focused on passing yet another stopgap funding bill to buy more time to work out the process of passing 12 separate appropriations bills and conferencing them with both chambers.

This notoriously unproductive Congress also has yet to broach the intense negotiations on a potential deal that would offer aid for Ukraine and Israel in exchange for border security provisions.

But in an election year, the tax deal could offer wins that both parties could take home to voters.

The left-leaning Center on Budget and Policy Priorities estimated that the child tax credit provisions ‘would lift as many as 400,000 children above the poverty line. 3 million more children would be made less poor as their incomes rise closer to the poverty line.’