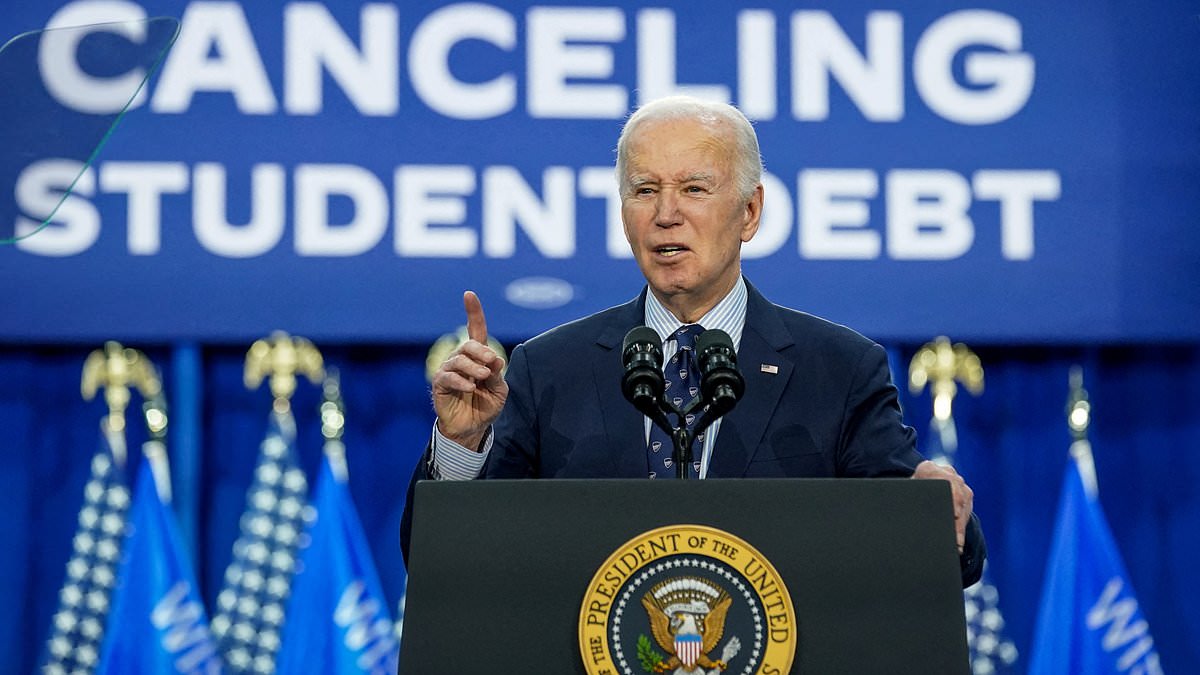

Joe Biden’s student debt relief plan suffered a major hit Monday as two federal judges partially blocked a measure of a plan that is costing the nation $160 billion.

Two federal judges in Kansas and Missouri on Monday sided with several Republican-led states and stopped the Democrat from moving forward with a key student debt relief initiative.

In total, the Administration has already approved almost $160 billion in relief for nearly 4.6 million borrowers.

U.S. District Judge Daniel Crabtree in Wichita, Kansas, blocked the U.S. Department of Education from proceeding with parts of a plan set to take effect July 1 designed to lower monthly payments and speed up loan forgiveness for millions of Americans.

He ruled shortly before U.S. District Judge John Ross in St. Louis, Missouri, issued a preliminary injunction barring the department from granting further loan forgiveness under the administration’s Saving on a Valuable Education (SAVE) Plan.

The SAVE plan is meant to tie monthly payments to the income and family size of a borrower.

This measure has already been used by eight million people, with over half with payments down to $0, according to CNN.

The plan was hatched by the Biden administration after their initial loan forgiveness program was stopped by the Supreme Court.

As part of the rulings, the White House must stop canceling federal student debt for those enrolled.

Biden and the Department of Education is yet to comment on the rulings.

The lawsuit reprises a courtroom showdown between the Biden administration and Missouri, which was a central figure in the Supreme Court case that overturned the Democratic president´s first try at loan cancellation last year.

In that case, the Supreme Court found that loan cancellation would harm Missouri because of its affiliation with a quasi-state loan servicing company, MOHELA, that stood to lose revenue generated by federal student loans.

The new lawsuit makes a similar argument. Biden´s new SAVE Plan speeds up an existing path to loan cancellation, which the suit says would deprive MOHELA – the Missouri Higher Education Loan Authority – of ‘up to 15 years in servicing fees.’

Also joining the suit were Arkansas, Florida, Georgia, North Dakota, Ohio and Oklahoma.

Congress created income-driven repayment plans in the 1990s to help borrowers who were struggling to make payments on student loans.

Those plans capped payments based on a borrower´s income and promised to cancel any remaining debt after 20 or 25 years.

Along with the harm to MOHELA, the lawsuit alleges that Biden´s plan makes it harder for states to hire and retain employees.

The repayment plan is so generous, according to the suit, that it undermines the Public Service Loan Forgiveness program, which allows borrowers to get student loans canceled after 10 years of work in public service jobs.

It´s an important recruiting tool for states, according to the lawsuit – out of 13 law school graduates hired by the Missouri attorney general´s office last year, almost all said Public Service Loan Forgiveness influenced their decision to work in the public sector.

‘Once the Final Rule takes effect, however, PSLF will not be nearly as attractive compared to other income-driven repayment programs,’ the suit says. ‘Its comparative advantage will shrink or disappear entirely.’

The states note that more than half of borrowers in the plan are paying nothing. ‘This is not a student loan program. It is a grant program that Congress never authorized,’ according to the suit.

Combining student loans into one big one federal debt consolidation loan is a required step for graduates with private loans to qualify for forgiveness programs.

In addition, a key factor in determining forgiveness is how many years Americans have been actively paying off their loans.

Depending on the program, this might be ten or 25 years – so having a full history can bring them closer to the threshold for forgiveness too.

‘The Department is working swiftly to ensure borrowers get credit for every month they’ve rightfully earned toward forgiveness,’ said US Under Secretary of Education James Kvaal.

As college costs soar, more students turn to loans to fund their degrees. But millions struggle to pay them back in the face of interest that keeps the total high even as payments are made.

This is a developing story.