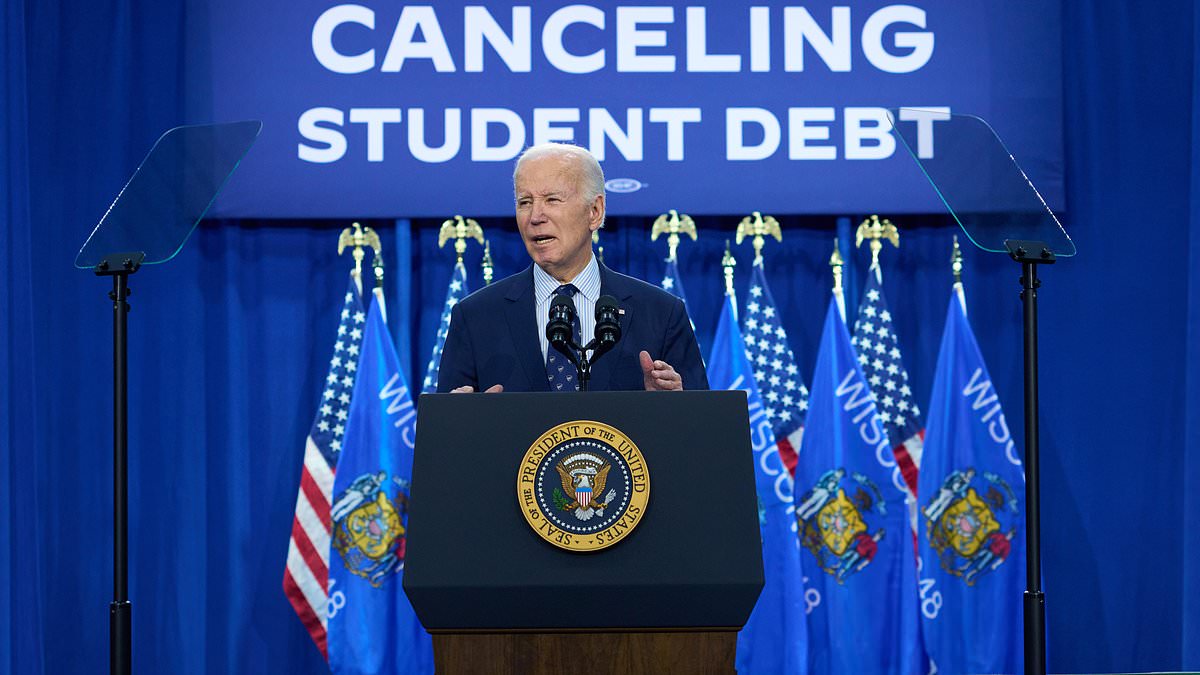

The Biden administration canceled an additional $4.28 billion in student loan debt as the end of the term ends in just one month.

The latest round of debt forgiven as approved for nearly 55,000 public service workers.

The move brings the total student loan debt forgiven under the Biden administration to nearly $180 billion for some 4.9 million borrowers.

However, the administration also announced it is withdrawing unfinished rules that would have provided for additional debt relief for more than 38 million Americans.

President Biden made canceling student loan debt one of the top priorities of his administration over the past four years, but as he prepares to depart office, some of those efforts were expected to be put on hold under Donald Trump.

With that, the Biden administration has taken multiple steps to wrap up work before Biden departs, but not everyone is happy about it.

Critics of debt cancelation have accused the administration of bailing out student loan borrowers by transferring the debt to American taxpayers.

At the same time, student loan advocates are expressing disappointment more was not accomplished in Biden’s term due to legal challenges.

The new relief announced Friday is the result of changes to the Public Service Loan Forgiveness (PSLF) program made since Biden took office.

The administration has forgiven $78 billion in debt for more than one million borrowers through PSLF.

‘Four years ago, the Biden-Harris Administration made a pledge to America’s teachers, service members, nurses, first responders, and other public servants that we would fix the broken Public Service Loan Forgiveness Program, and I’m proud to say that we delivered,’ said Education Secretary Miguel Cardona in a statement.

Just 7,000 borrowers qualified for the loan forgiveness program before Biden took office and his team made PSLF changes.

Borrowers in public service jobs qualify to have debt forgiven after making 120 qualified payments.

Apart from making technical changes to the program, the Biden administration also made it so more borrowers could participate, and made it so the program is managed by the Education Department rather than another loan servicer so borrowers could track where they stand in terms of having their debt canceled.

Apart from forgiving debt for pubic service workers, the Biden administration has also made strides to cancel debt for borrowers through the Income-Driven Repayment plans which has amounted in more than $56 billion being canceled for 1.4 million borrowers under Biden.

Another 1.6 million borrowers have seen $28.7 billion wiped out after being cheated by schools while more than half a million borrowers saw $16.2 billion in debt canceled for permanent disability during his term.

But some of Biden’s key plans to cancel student loan debt for a broader swath of borrowers might not come to be before he exits office in January.

The president’s first plan to cancel up to $20,000 in student loan debt for qualified borrowers was blocked by the U.S. Supreme Court in June 2023.

After that, Biden went to a so-called ‘Plan B,’ but the administration announced it would withdraw those proposed rules as the clock ticks down as the effort faced legal challenges.

Should the proposed rules be left as is and not scrapped, the Trump administration could use them to advance its own agenda more quickly.

The plan unveiled earlier this year would have eliminate accrued interest for more than 20 million borrowers who owe more money on their student loans than they originally took out. It also cut down the time borrowers would have to repay their loans before seeing forgiveness.

‘We are deeply disappointed that the actions of right-wing attorneys general have blocked tens of millions of borrowers from accessing critical student debt relief,’ said Persis Yu of the Student Borrower Protection Center.

‘President Biden’s proposals would have freed millions from the crushing weight of the student debt crisis and unlocked economic mobility for millions more workers and families,’ she added.

Biden’s separate Saving on Valuable Education (SAVE) plan launched earlier this year through the rule-making process was also challenged by Republicans and has been temporarily blocked by the courts.

The plan would have lowered monthly payments for borrowers relative to other income-driven repayment plans, stopped interest from building up and allowed some borrowers to see their debts erased after ten years rather than the standard 20 to 25 years.

The incoming Trump administration could simply drop the case essentially pausing the plan altogether, but the courts still need to weigh in.

If the SAVE plan does not move forward, it would mean many borrowers could face higher costs when payments resume.