The Barefoot Investor has vowed to never give up on cash after spending a week refusing to use any other forms of payment.

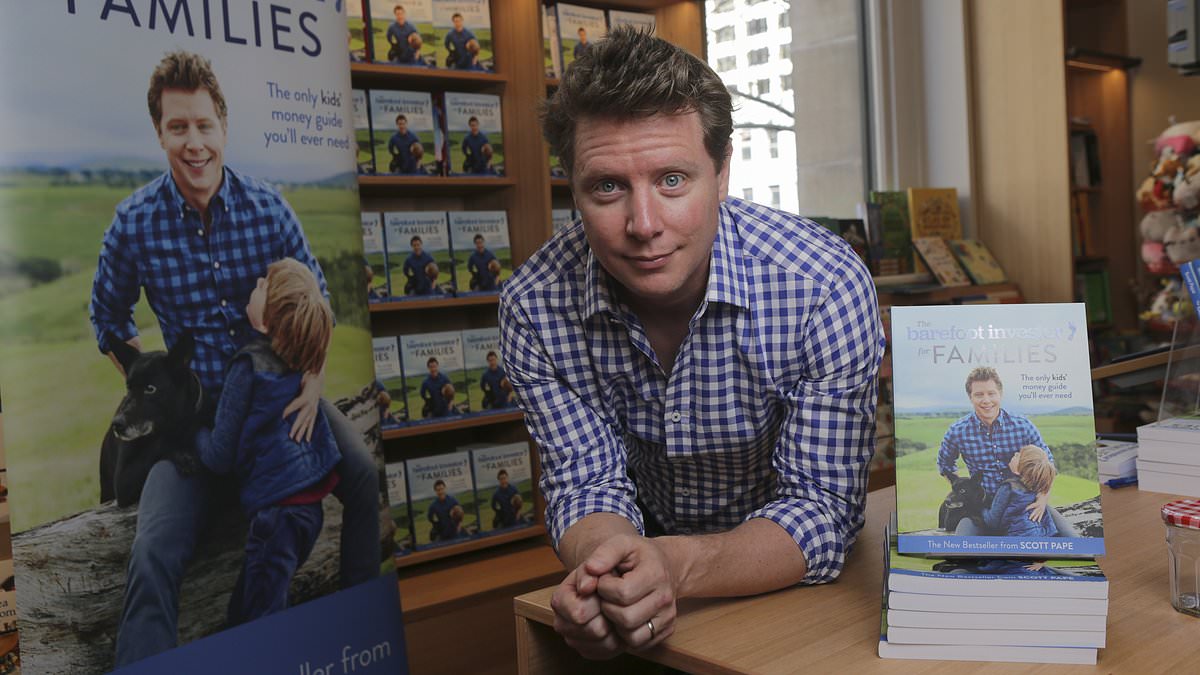

Scott Pape revealed he forced himself to follow a seven-day trial period where he would only use cash to pay for everything.

The financial guru revealed the setbacks of not using a debit or credit card came to a head when he attempted to pay for a burrito at a fast food restaurant.

The teenage takeaway assistant told him the venue did not accept cash.

When he told her he didn’t have a card, she spent 10 seconds looking at him, trying to figure out what was going on.

‘I wanted to tell her that I was doing an experiment of using only cash for a week, and that I was in fact a successful financial expert,’ Mr Pape wrote in his column for The Daily Telegraph.

He also wanted to tell her that he was very hungry.

‘But I didn’t do any of those things. I just stood there like an idiot,’ he said.

She then asked, in a pitying tone, if there was someone he could call. He told her he didn’t have a phone with him. ‘And even if I did … my wife wouldn’t help.’

He left without his burrito, the attempted transaction having failed.

Mr Pape’s experiment left him with so many coins in his pocket that his four-year-old asked, ‘Why are you jingling like Captain Feathersword, Daddy?’

He said the sheer weight of them gave him a pain in his back and got him wondering how much it costs to make these now little used coins.

So he called up the Royal n Mint and promptly got the run around.

When finally, days later, her got on to an executive from the Mint, he was told ‘Your request is currently with the privacy department … because it’s commercial in confidence.’

‘Commercial in confidence? Who the hell are you competing with, the Vietnamese dong?’ he joked, but the executive didn’t find it funny.

‘We don’t give (information about coin production) out,’ she added, in case he hadn’t got the message.

According to Reserve Bank figures, though, in the 12 years to 2022, cash transactions in dropped from more than 60 per cent to just 13 per cent.

The end result is that the Mint makes far fewer notes and coins, which has led to a lot less business for Armaguard, who take the currency to banks.

Mr Pape took his quest to find how much it costs to make coins and note to Andrew Leigh, the minister responsible for the Mint.

But an adviser in Mr Leigh’s office was just as unhelpful as the Mint. ‘If the Mint won’t tell you, we can’t tell you. What the Mint says is gospel’, he was told.

Mr Pape replied that ‘No, your Minister is God and he writes the gospel. And I think taxpayers have a right to know how much our coins are costing us.’

‘What was your name again? Is this for a podcast? How many followers do you have,’ the adviser asked.

‘I’m the Barefoot Investor. Look me up,’ he said.

Mr Leigh sent him a text the next day, saying ‘Scott, I’m sorry the Mint wasn’t able to get you the figures you were after.

‘As you’d appreciate, the Mint makes the call themselves on issues like disclosing costs.’

But Mr Pape didn’t ‘appreciate’ that highly paid bureaucrats think they’re too important to answer to the people who pay their salaries.

He wrote in his newsletter that not only is he a huge fan of cash, he believes it’s worth the cost to taxpayers to keep it in circulation.

The Barefoot Investor explained that our currency is part of ‘s national identity and our security.

He explained that Sweden’s move towards being a cashless society means they’ve got ‘the lowest amount of physical cash floating around of any countries in the world’.

But their government is now having second thoughts.

Amid the ongoing Russia-Ukraine war, in November 2024, the Swedish Ministry of Defence sent every household a brochure called ‘If Crisis or War Comes’.

It advised citizens to withdraw and use cash regularly, keeping at least a week’s worth on hand, because if cybercriminals or warring nations interfere with digital payments, tapping your card won’t work.

Another reason Mr Pape is a cash fan is because it’s a great visual aid for teaching children the value of money.

His final reason is that ‘because the people who really run Canberra – the n Taxation Office – despise cash, since it can’t be tracked,’ he wrote.

‘They want every payment to be electronic so they can suck up all that data and feed it through their AI supercomputers to track our every financial move.’

He added that the bureaucratic runaround he had been given this week ‘is exactly why we should never surrender cash’.