The Bank of England snubbed pleas for interest rate cuts today amid fears inflation is still a threat.

The Monetary Policy Committee announced the base rate is being kept on hold at 4.5 per cent after its latest meeting.

The members had been given more grounds for caution this morning with figures showing wages still rising at the highest level since last April.

And eight voted to pause the level, with just one backing a reduction. The Pound immediately ticked up against the US dollar on the news, with markets pricing in a slower downward trajectory for rates.

However, concerns about the wider picture in the economy are deepening, with the jobs market flat even before Labour’s national insurance raid takes effect – and Donald Trump’s trade war gathering pace.

The spectre of so-called ‘Stagflation’ has reappeared with bodies such as the OECD joining the Bank in slashing growth forecasts.

Rachel Reeves is due to deliver a crucial Spring Statement next week as she struggles to balance the books.

The Chancellor has signalled that there will not be tax changes for the time being – leaving her having to fill an estimated £15billion black hole in the finances with spending cuts.

That was only partially covered by the curbs to benefits announced by the government earlier this week.

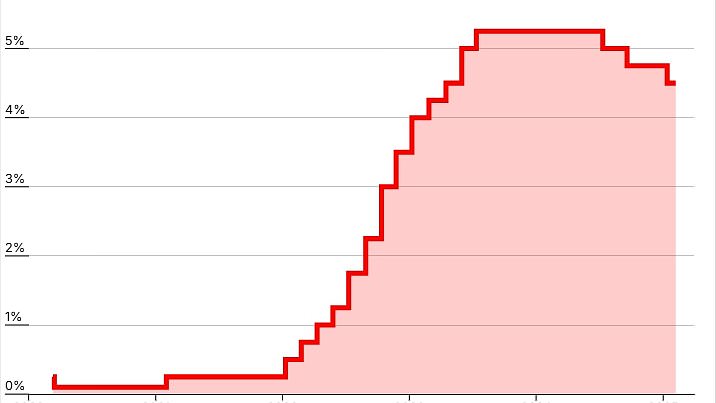

The MPC has been gradually cutting borrowing costs since August, easing pressure on some borrowers who have been able to offer lower mortgage rates.

That has been assisted by inflation steadily falling from the highs reached in 2023, when the cost-of-living crisis peaked.

But the Bank’s governor Andrew Bailey has been keen to stress that the committee wants to take a ‘gradual and careful approach’ to reducing rates while monitoring changes in the UK and global economy.

CPI rose to 3 per cent in January, with price pressure mainly being driven by energy prices, water bills and bus fares.

At the same time, the UK economy has been teetering on the edge of decline – with GDP down 0.1 per cent in January – and effectively at a standstill with 0.1 per cent expansion over the final three months of the year.

The OECD warned this week that ‘further fragmentation of the global economy’ was a significant concern amid trade tensions sparked by Mr Trump.

It said that would likely increase inflation around the world and have an impact on living standards.

Figures from the ONS this morning showed regular average annual wage growth was unchanged at 5.9 per cent in the three months to January, staying at the highest level since the three months to April last year.

Wages outstripped headline CPI inflation by 3.2 per cent, the ONS added.