The IMF has kept its forecast for the UK economy unchanged despite Keir Starmer making higher growth his ‘central mission’.

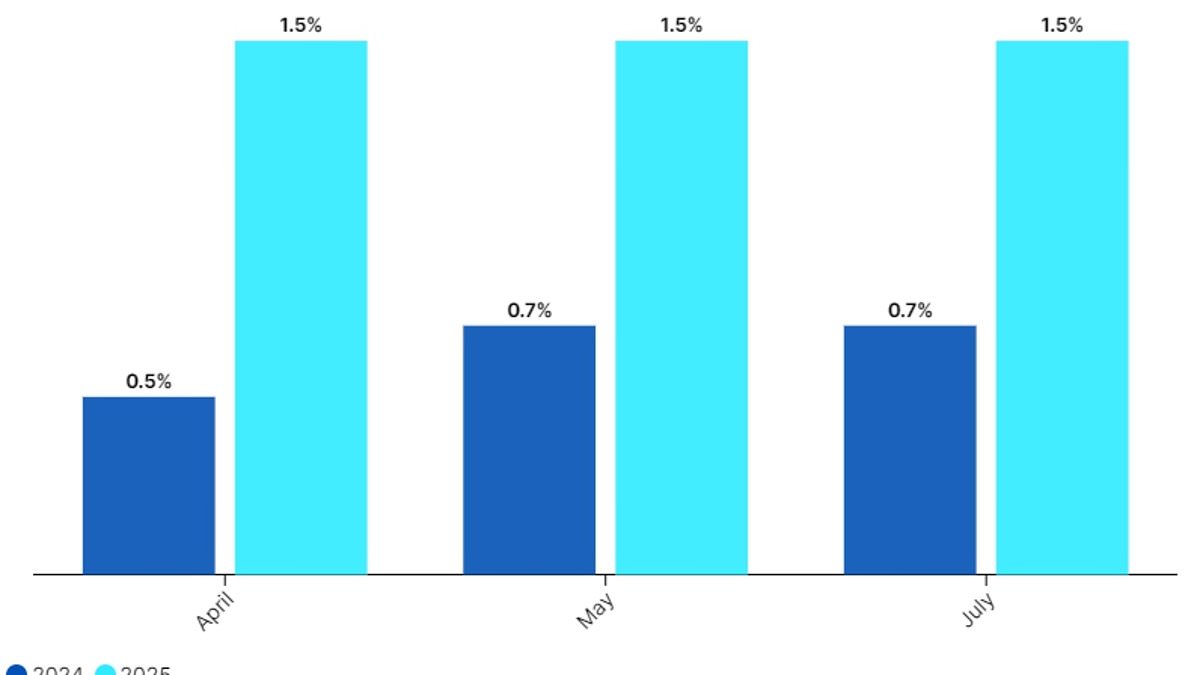

The international body is predicting GDP will rise by 0.7 per cent this year and 1.5 per cent in 2025. It had already bumped up the estimates in May as the Tories cut taxes to boost activity.

But there was no further improvement pencilled in from the new PM’s commitments, including a huge overhaul of planning to make it easier to force through housing developments and major infrastructure.

With the Bank of England set to make a crucial decision in just over a fortnight, the IMF also warned there is an increased prospect of ‘higher-for-even-longer’ interest rates due to persistent wage and services inflation.

The latest World Economic Outlook report said elections across the world have increased ‘uncertainty’ over economic growth amid concerns over ‘significant swings’ in policy from new governments.

The IMF maintained its projection that the global economy will grow by 3.2 per cent in 2024, but pointed towards slightly stronger growth in 2025 at 3.3 per cent.

It had previously also forecast 3.2 per cent growth for 2025.

‘The potential for significant swings in economic policy as a result of elections this year, with negative spill-overs to the rest of the world, has increased the uncertainty around the baseline,’ the IMF said in the latest outlook update.

It comes amid a backdrop of falling inflation, although the report highlighted that this decline has slowed down in recent months.

‘The momentum on global disinflation is slowing, signalling bumps along the path,’ the IMF said.

‘Services price inflation is holding up progress on disinflation, which is complicating monetary policy normalization.’

Interest rates have been broadly increased globally as countries have sought to grapple with high levels of inflation over the past two years.

In the UK, interest rates currently sit at a 16-year-high of 5.25 per cent, with BoE policymakers opting to maintain rates at this level for the past seven meetings.

The IMF said concerns over wage inflation and service industry inflation, which have remained more persistent than over areas of the economy, mean that interest rates are taking longer than previously expected to decrease.

It added: ‘The risk of elevated inflation has raised the prospects of higher-for-even-longer interest rates, which in turn increases external, fiscal, and financial risks.’

Sir Keir told Cabinet today that the critical King’s Speech will focus on the ‘mission of economic growth’.

The PM and his senior team met to put the final touches to the legislative plans being unveiled tomorrow – designed to show that Labour has hit the ground running with its ‘change’ promise.

Ministers heard there was a ‘packed agenda’ that would make progress on the government’s desire to get GDP rising.

Strategists have warned Sir Keir has a narrow window to get the public on board with his plans, after securing on of the biggest landslides in history on just 34 per cent of the popular vote.

A national truant register, treating Channel boats gangs as terrorists and a Net Zero push are all set to feature as the monarch kick-starts the Parliamentary session with the usual pomp and ceremony.

The package of around 35 bills could include moves to scrap the remaining 92 hereditary peers – although the mandatory retirement age of 80 in the Lords could wait.

Spiking drinks will be made a specific criminal offence, and police will be ordered to tackle lower-value shoplifting.