Every good villain needs a lair, and for Neil Woodford that place has in recent years been a seven-bedroom trophy home overlooking the azure-blue water of Salcombe Harbour.

The disgraced fund manager purchased his 6,280sq ft pile for £6.3million in 2017, before proceeding to have it, in the words of his architect, ‘fitted out to the highest possible standard’ with floor-to-ceiling windows, a ‘sleek Boffi kitchen’, bespoke joinery and endless modern art.

A sunken hot-tub was added to the garden, next to a sun-deck offering stunning views of yachts bobbing around in the estuary of the ultra-posh South Devon holiday town, which is nicknamed ‘Chelsea-on-Sea’.

Rooms were kitted out with enough high-end technology to make a footballer’s wife blush, with touch panels controlling hidden speakers, flat-screen TVs, automated doors, intruder alarms and even a ‘window treatment control system’.

At the time, Woodford was at the peak of his powers, with hundreds of thousands of Britain’s savers and pension holders entrusting him to manage an astonishing £17billion of their hard-earned cash.

A pugnacious character, famed for his supreme self-confidence, Woodford’s talent for stock-picking had seen him credited with ‘making Middle England rich’, with the BBC dubbing him ‘the man who can’t stop making money’. At one point, he was invited to meet the Queen, and garlanded with a CBE, for ‘services to the British economy’.

The financial spoils were considerable. A few years before acquiring his Salcombe holiday pile, he spent £13.4milllion on a 1,000-acre Cotswold estate.

That was pimped up with state-of-the-art equestrian facilities, including stabling for 18 horses and indoor and outdoor arenas to indulge a growing passion for eventing and showjumping that, according to the FT newspaper, saw him acquire a special mobile telephone system to allow him to trade while in the saddle.

For the daily commute, to an Oxfordshire office where his name hung above the door, he could choose from a fleet of Ferraris and Porsches. On his wrist, he liked to wear what an interviewer once described as ‘watches so chunky they could double as gym apparatus’.

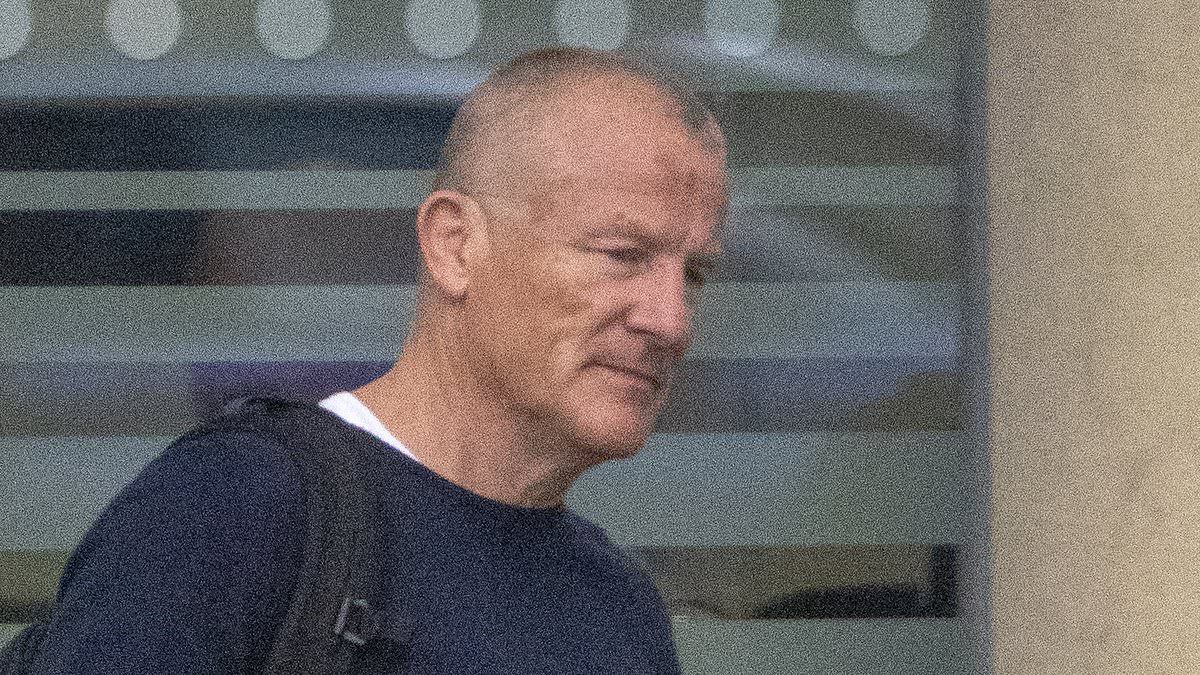

Woodford’s turbo-charged success was, to all outward appearances, at one with our meritocratic times. The grammar-school educated son of a postcard printer, he eschewed pinstripes and gentlemen’s club ties for a Steve Jobs-style uniform of black sweatshirts and jeans in magazine photoshoots which would show off his weightlifter’s biceps and expensive suntan.

But then, everything went wrong.

In 2019, Woodford Investment Management [WIM] imploded, thanks to a series of bad bets which had seen the value of its main ‘equity income’ funds crater, leaving the company struggling to pay investors who wished to access their nest eggs. About 300,000 people were frozen out of savings worth approximately £3.6billion.

Neil Woodford was fired and the fund dissolved. Ordinary Britons who had entrusted him with their cash remain £1billion out of pocket.

This week, the scandal returned to the public eye after the Financial Conduct Authority finally got around to completing a lengthy inquiry into the affair. It has decided to hit Woodford with a fine of almost £6million and banned him from both holding ‘senior manager’ roles and managing funds for retail investors.

In a 120-page ruling, the City regulator said the 65-year-old financier had ‘made unreasonable and inappropriate investment decisions’ and shown an egregious ‘lack of competence, capability and reputation’ which was ‘serious and sustained’.

This revealed him as no longer ‘a fit and proper person’ to be entrusted with people’s savings and investments.

The FCA also announced that it intends to fine WIM another £40million, though whether it will ever see that money is unclear since the once cash-soaked firm, which counts Woodford as its sole director and ‘ultimate controlling party,’ now has a mere £29,000 in assets against £259,000 in debt, according to its most recent accounts.

In other words, Joe Public will almost certainly remain on the hook. Woodford is meanwhile going to appeal the judgement. But it seems unlikely that either his reputation, or bank balance, will ever return to their once-giddy heights.

All of which brings us back to sunny Salcombe. For in a development which perhaps speaks volumes for the staggering extent of his fall from grace, I can reveal that Woodford’s trophy home has been placed on the market.

The ‘unique and beautifully appointed coastal property’ with its ‘expansive terraces and balconies that draw in stunning estuary views at every opportunity’ was listed by Savills for £9,995,000 in late May. Particulars gave a fascinating insight into his champagne lifestyle, waxing lyrical about the ‘integrated Gaggenau appliances’ in its 56-foot-long brushed chrome kitchen, which offers ‘seamless indoor-outdoor living with floor to ceiling glass that opens to a large balcony private terrace that leads to the garden… perfect for al fresco dining while watching the boats go by’.

It’s unclear whether the lofty asking price would allow Woodford to realise much of a profit on the Devon bolthole, which he bought for cash eight years ago, once the cost of refurbishment, stamp duty and any capital gains taxes are factored in.

Neither can we be sure whether the proceeds will even cover the full cost of Woodford’s personal fine, which is £5,888,800.

For property records further reveal that in September 2019, three months after his fund collapsed, Woodford and his second wife Madelaine, who co-own the property, took out a loan with Rothschild & Co Wealth Management, which was secured against it. The bank will therefore have to be reimbursed before any proceeds drop into his coffers.

Asked about the listing, a spokesman for Woodford said: ‘We’re not commenting on speculation regarding personal matters’. Confusingly, the property seems to have suddenly disappeared from the Savills internet site around the time the Mail began to ask questions.

What we do know, however, is that he won’t starve. Or suffer the sort of extreme financial hardship being felt by some of his investors, whom I met via a Zoom meeting organised by the Woodford Campaign Group, representing investors who lost money due to the scandal. These are ordinary folk, who had life-changing chunks of their pensions or ISAs invested in the funds that bear his name.

One of the speakers, a retiree from Lincoln named Neil Taylor, had £76,000 tied up with Woodford’s firm when it hit the skids in 2019. Six long years later, he’s still tens of thousands out of pocket.

For ex-masters of the universe such as Woodford, belt-tightening takes a different form. Back in 2020, he also offloaded the aforementioned Cotswold estate, near Tetbury, for £26million, netting a £13million profit (it’s currently owned by Samuel Houser, the tech tycoon who made his fortune by creating the violent video game Grand Theft Auto).

An interviewer who asked about that transaction was told: ‘I don’t want to go into the details, but retail investors were not the only people who suffered financially as a result of what happened.’

Neil and horse-mad Madelaine, his 6ft tall former secretary, with whom he has two teenage children, have also been forced to curtail their expensive equestrian activities.

They once owned no fewer than 18 eventing horses. Despite admitting that he’d ‘fallen off far too many times’ while learning the ropes, Woodford was so obsessed by this ‘fantastic’ and ‘exhilarating’ sport, that in May 2019 as his investment company teetered on the brink, he could be found not at his office on a drab industrial estate in Cowley, but instead riding across a scenic estate at Tweseldown in Hampshire (he performed well in the cross country and show-jumping disciplines, but badly let himself down in dressage, coming 12th out of the 15 entrants who managed to finish).

In the months that followed, three of his most expensive horses, which cost an estimated £1,000 a month each to stable, were sold. British Eventing records state that the couple now make do with a mere 13, although some of them are likely to have been retired.

To victims, the downfall of a man once regarded as Britain’s version of Warren Buffett is an old-fashioned tale of greed, hubris and arrogance, which saw hundreds of millions of pounds end up in the pocket of rapacious financiers, while hapless consumers lost around £1billion and regulators twiddled their thumbs.

Woodford built his reputation at City firm Invesco in the late 1980s, as a hungry Exeter University graduate (he’d studied agricultural economics) who failed in his efforts to fly jets in the RAF after tests showed that he had insufficiently fast reflexes and instead went into finance, where he developed an aptitude for picking shares.

His favoured technique revolved around ‘value investing’ in which he’d seek out undervalued stocks in high-quality companies and hold them for the long term.

In the 1990s, profitable bets included tobacco firms, which were throwing off heaps of cash despite being targeted by regulators and shunned by self-styled ‘ethical’ investors.

This approach helped him avoid not just the dotcom bubble of the late 1990s, but also the worst effects of the 2008 financial crash, after he successfully predicted that the mania for ‘debt-fuelled consumption’ was coming to an end and avoided overheated financial stocks.

It was especially popular with ordinary retail investors, many of whom are naturally cautious. They piled their pension and ISA savings into Woodford’s funds.

At Invesco, where he ran the Perpetual High Income Fund from 1988, a client who invested £10,000 at the start of his 25-year stint would have walked away with an astonishing £230,000, an annual return of around 12 per cent.

By the end of his tenure, he was therefore a genuine stock-market Goliath, looking after £33billion on their behalf, and effectively controlling the largest stake in 30 of Britain’s 250 largest companies.

Little wonder that when he left Invesco to set up on his own, in 2014, he was able to raise £1.7billion in funds from prospective clients in two weeks, a British record. Within a year, his firm Woodford Investment Management was managing £7billion. At its peak, that number hit £17billion. There were 45 employees, each earning an average salary of £231,000.

On paper, Woodford’s main venture was an ‘Equity Income’ fund which aimed to hold shares in quality blue chip firms – many of them UK-based – which would pay hefty annual dividends to shareholders, as per his historic approach. But such stocks were, at the time, firmly out of fashion, with far greater returns being realised in more volatile emerging markets and technology stocks.

He therefore began playing a riskier game: taking large stakes in early-stage companies which were not yet quoted on the stock-market and didn’t offer any dividend income. While these investments could potentially realise huge future profits, their outcome can be highly uncertain.

What’s more, while normal blue-chip shares can be bought and sold at the push of a button, a stake in a privately-owned firm requires a willing buyer and a time-consuming valuation process to offload.

That started to become a problem in the aftermath of the Brexit referendum, when several of the companies in his fund’s regular portfolio, including Rolls-Royce, Provident Financial, construction giant Keir Group and the AA experienced large falls in their share price.

With returns suffering, investors began pulling money. On paper, they were entitled to be reimbursed in four days. But the only way for Woodford to raise cash to pay them in that timeframe was to sell off blue-chip shares. As a result, the proportion of difficult-to-sell unlisted holdings in his ‘Equity Income’ funds began to steadily increase.

In one 12-month period, to July 2018, 87 per cent of Woodford’s sales were of quoted, largely blue-chip stocks. The proportion of the fund devoted to unquoted stocks – usually in risky sectors such biotech and early-stage healthcare – therefore increased dramatically.

But that led to more investors seeking an exit. And so a sort of doom loop was created. In May 2019, a request by Kent County Council to withdraw a £237million holding pushed things to crisis point. Within a couple of weeks, the fund was suspended.

As the balloon was going up, Woodford displayed astonishing arrogance, bickering with compliance officials who raised concerns about the fund’s illiquidity.

In March 2019, he told the firm’s board that he had ‘never been more right in my career’ about his investment strategy, while professionals who were trying to curb him were, he said, subject to a kind of ‘madness’.

After one ‘fractious’ meeting, in which the fund’s ‘Authorised Corporate Director’ Link Fund Solutions sought (it seems in vain) to persuade Woodford to change course, a Link Employee sent a memo saying: ‘This is just Woodford all over. Give them an inch and they take a mile. They should have acted immediately to take it [illiquid holdings] down.’

With investors locked out, details of the huge profits made by Woodford began to emerge.

According to The Times, Woodford and his co-founder, one Craig Newman, had extracted a quite grotesque £98million from Woodford Investment Management via dividends in the four years before the collapse.

Even after the fund’s suspension, their firm was charging stakeholders £65,000 a day in management fees.

The insouciance continues to this day. Just before Christmas Woodford agreed to speak at length about his fund’s collapse on a podcast. There followed a remarkable performance in which he sought to blame the media, Link Fund Solutions, and even Brexit for the whole thing, at one point tearfully declaring ‘There were some very lonely, very dark moments. And of course, it had an impact on me, my mental health, my family. As you can imagine, it was horrendous.’

Completely missing from the exchange was any meaningful acknowledgement of his own gargantuan failings. They have finally been laid bare in this week’s devastating FCA ruling.

As to the future, the owner of Salcombe’s swankiest home may now be banned from senior City roles, but that hasn’t stopped him launching a new business venture, named W4.0.

It’s a sort of share-tipping website, in which subscribers can access the fallen star’s ‘latest investment strategies’, for the bargain price of £53 per month. Those who pay £70 per month can also enjoy ‘group Q&A sessions with Neil’.

Only time will tell whether they, like so many former Woodford clients, will end up counting the cost.