Silence can often say more than words ever could.

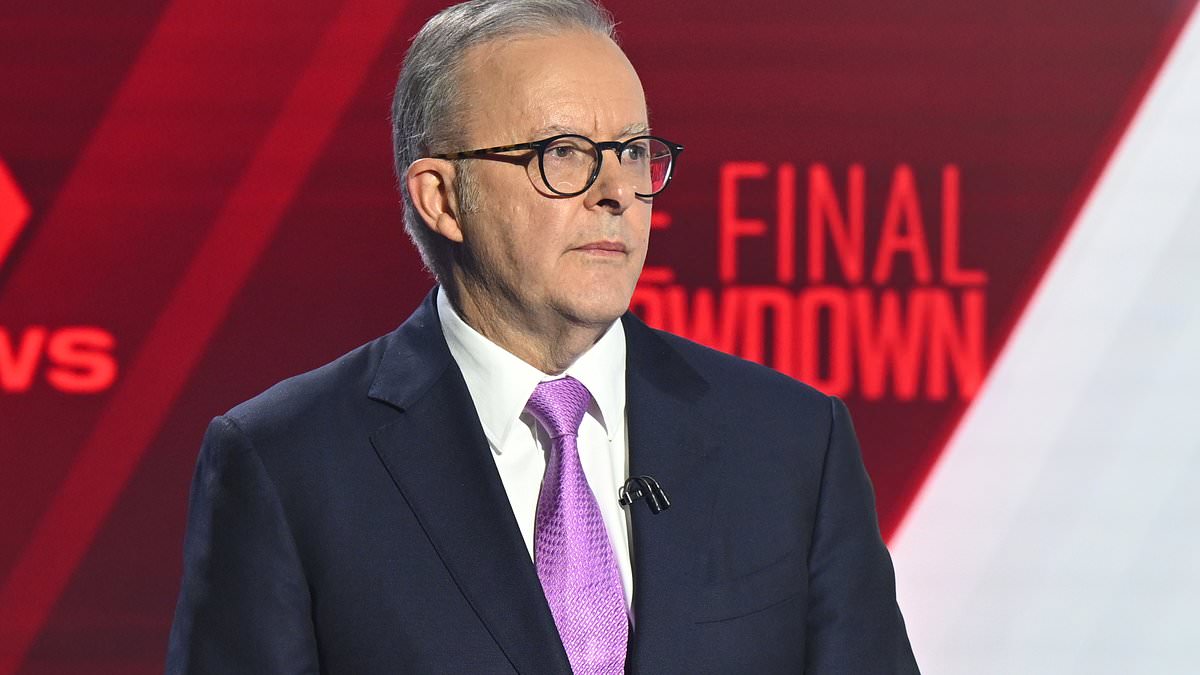

And every hard-working n should be worried about Prime Minister Anthony Albanese’s stony-faced response to Peter Dutton during the final leaders’ debate as the opposition leader confronted him with cold, hard facts about Labor’s tax policy.

The PM has gone to the election with a plan to impose a 30 per cent tax on unrealised gains above a $3million threshold. It’s a complex policy not widely understood, or indeed widely implemented anywhere in the world, and perhaps Labor is banking on voters not understanding the implications of it as they head into the polls.

Put simply, retirement savings above $3million would be taxed before an asset is sold. This would be a radical departure from the usual approach of only paying the capital gains tax once something has been offloaded.

This policy would particularly hurt those with a self-managed super funds who own assets such as farms or real estate.

No other country in the world has even tried this policy on retirement savings – known in as the Division 296 tax – and farmers, small businesses and a leading superannuation group have condemned the policy as ‘confiscation’ of assets.

Pauline Vamos, who chairs Ardea Funds Management and the Governance Institute of , says taxing unrealised gains is so complicated it could be hard for ns to sell property assets in their self-managed super fund to avoid paying the tax.

‘Yes, and they do not necessarily have the liquidity in their funds to pay for it,’ she tells me.

Former U.S. vice president Kamala Harris resoundingly lost last year’s presidential election to Donald Trump after going to the people with a Swedish-style policy to apply an unrealised gains tax to the ultra-rich with assets worth more than US$100million.

Three weeks after the Democrat lost the election, ‘s Parliament declined to pass Labor’s Treasury Laws Amendment (Better Targeted Superannuation Concessions and Other Measures) Bill 2023.

Despite that setback, the Albanese Government has taken this policy to this Saturday’s election – and it was raised during Sunday night’s leaders’ debate.

The Labor leader stayed silent as Dutton, who polls suggest will not win the election, pointed out the ALP still had plans to tax unrealised gains on super.

‘The prime minister said before the last election that there’d be no changes to superannuation and the prime minister [has] introduced a tax, which taxes an unrealised capital gain,’ Mr Dutton said.

‘So, just to put that into basic terms, if you’ve got shares, and the shares go up in value, if you’ve got a house and the house goes up in value, this government is going to tax you on that gain before you actually sell the shares or sell the house.’

Seven Network moderator Mark Riley pointed out the law hadn’t been changed to tax unrealised gains on super.

‘We know that’s caught up in the Parliament – that’s not law,’ he interrupted.

But again, Mr Albanese stayed silent – with no interjection made to defend the super plan – as Mr Dutton reiterated that taxing unrealised gains was still Labor Party policy.

‘But that’s the government’s policy. That’s the policy of it before the election,’ the opposition leader stated.

Labor failed to get its policy through the Senate during the last sitting day of Parliament in November last year, and it didn’t bother putting the legislation in front of lawmakers again in early 2025 before the election was called days after the March Budget.

The Greens blocked the Labor plan – not because they disagreed on principle but because they wanted the threshold reduced from $3million to $2million.

With taxing unrealised gains still Labor policy – and the looming prospect of a minority government with the Greens who want an even lower threshold – the Self-Managed Super Funds Association, the National Farmers Federation, the Council of Small Business Organisations and the Family Business Association have released a joint statement pleading with the government to drop it.

‘Let’s be clear: taxing someone on paper gains they haven’t received a cent from is not reform – it’s confiscation,’ they said.

‘It punishes aspiration, destroys liquidity and turns volatile market movements into tax bills.’

They argue that taxing unrealised gains on super would set a dangerous precedent.

‘Once taxing unrealised gains becomes embedded in superannuation, it opens the door to expansion across the entire tax system,’ the group stated.

Pat Conaghan, a Nationals MP representing the marginal NSW north coast seat of Cowper, fears taxing unrealised gains on retirement savings will hit more than just farmers in his rural electorate with self-managed super funds.

‘Other young people need to understand this will continue on for them into the future,’ he told community radio station 2Way FM.

‘Not only the farmers, not only the people who have worked hard and succeeded – they’ll be affected by these unrealised capital gains tax and it will hurt their back pocket.’

The idea of taxing unrealised gains would be the most radical change to capital gains tax since it debuted in 1985, under Bob Hawke’s Labor government.

During the past four decades, the likes of investment properties and shares have only been taxed once something has been sold.

Labor’s plan also includes doubling the tax to 30 per cent on super earnings above $3million, with the government arguing it would affect just 0.5 per cent, or 80,000 retirees.

The Coalition is opposed to Labor’s super policy of taxing unrealised gains, with Teal independents in both houses of Parliament, Allegra Spender and David Pocock, also raising concerns about it.

Should Labor fail to secure a majority at Saturday’s election, it could be forced to form a minority government with the Greens who want a more radical approach taken to taxing unrealised gains on super.

The minor party also wants Labor to restrict negative gearing tax breaks for investor landlords to one property.

The only hope would be if Labor, in the absence of a majority, chose to instead only deal with Climate 200 independent MPs representing wealthy electorates in Sydney and Melbourne, who are lukewarm about taxing unrealised gains on super.