Britain’s growth outlook has been sharply downgraded by the International Monetary Fund in a fresh blow for Labour – as Donald Trump’s tariff wars deliver a severe hit to the global economy.

Higher bills for hard-pressed UK consumers were also blamed as the IMF forecast growth of just 1.1 per cent in 2025, 0.5 percentage points down from its previous outlook.

The outlook for 2026 has also been downgraded, from 1.5 per cent to 1.4 per cent, by the Washington-based IMF.

Weak growth presents Chancellor Rachel Reeves with a headache as she tries to meet her fiscal targets without having to hike taxes or cut spending at her next Budget in the autumn.

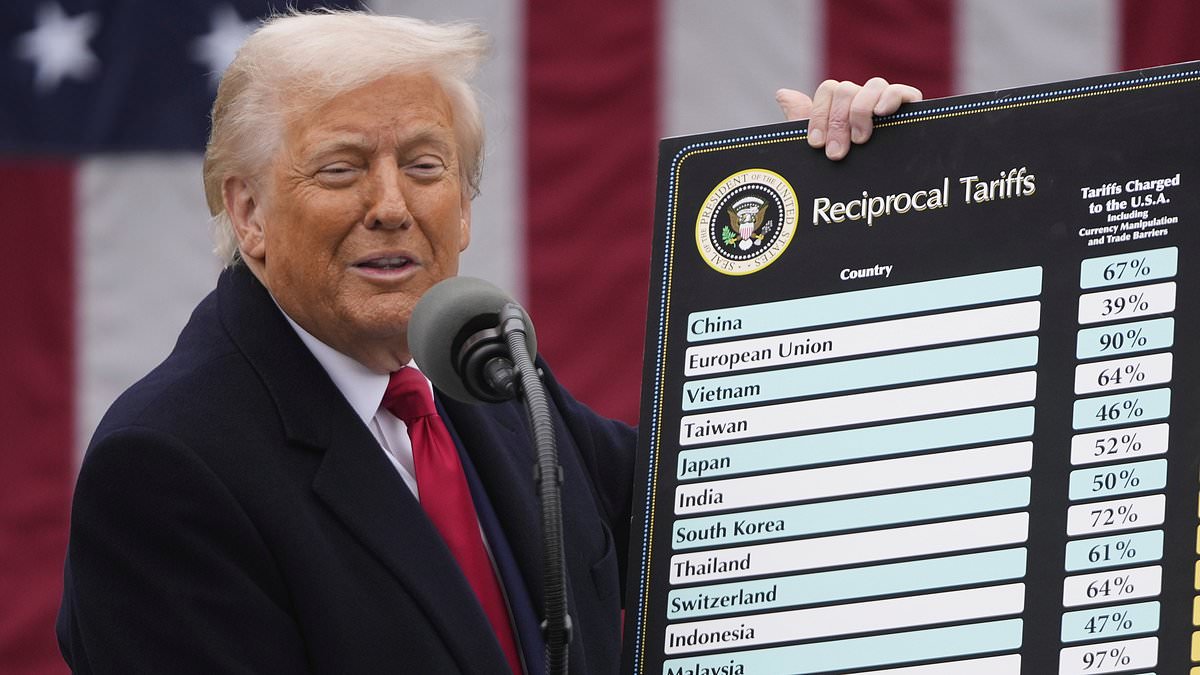

The report comes after Mr Trump’s tariff announcements sparked global market turmoil – including a rise in the cost of UK borrowing as yields on government bonds, known as gilts, climbed.

Responding to the projections, the Chancellor noted the forecast ‘shows that the UK is still the fastest growing European G7 country’.

But there was no acknowledgement of the growth downgrade or the sharp rise in IMF estimates for UK inflation.

Ms Reeves added that the World Economic Outlook (WEO) report ‘clearly shows that the world has changed, which is why I will be in Washington this week defending British interests and making the case for free and fair trade’.

The report blames the UK downgrade on ‘recent tariff announcements, an increase in gilt yields and weaker private consumption amid higher inflation’.

The IMF’s forecast will be an embarrassment to the Prime Minister after he repeatedly pledged to boost growth in Britain’s economy. It also points to a bleaker picture for the cost of living.

Tax hikes and imposed price increases on water, energy and other public services – partly driven by the climate change agenda – are expected to lead to a sharp 0.6 percentage point rise in inflation to 3.1 per cent this year.

This will make it harder for the Bank of England to deliver the interest rate reductions required to boost consumer confidence, the housing market and business investment.

Despite the growth downgrade Britain will still be among the fastest expanding countries among the Group of Seven richest nations.

It is predicted to be way ahead of competitors in Germany, France and Italy, which will stagnate in 2025 with no signs of any upturn until 2026.

The IMF’s emphasis on the deep damage being done to British, American and worldwide growth by President Trump’s erratic trade war underlines the importance of Ms Reeves’s effort to carve out an early trade deal with the US when she meets this week with the US Treasury Secretary Scott Bessent.

The UK, like much of the rest of the world, is currently subject to a 10 per cent tariff on all its physical trade, which may be difficult to shift.

More damaging is the 25 per cent tariff on car and specialist steel exports, which has already led luxury car maker Jaguar Land Rover to suspend exports to the US – its biggest overseas market.

The IMF’s top economists are unrelenting in their criticism of the harm the imposition of tariffs is doing to US, UK and international prosperity.

‘Major policy shifts are resetting the global trade system and giving rise to uncertainty that is once again testing the resilience of the global economy,’ the report said.

The tariffs, it notes, ‘triggered historic drops in major equity indices and spikes in bond yields’.

The IMF has downgraded the outlook for global growth from 3.3 per cent to 2.8 per cent for this year. And the US economy is expected to grow by just 1.8 per cent, down from 2.7 per cent previously predicted.

Britain finds itself directly in the line of fire. Despite £40bn of tax increases imposed in last October’s Budget the cost of servicing the nation’s national debt, at 100 per cent of output, remains stubbornly high.

The markets remain doubtful that Ms Reeves can fix the public finances. Moreover, when US bond yields rise the UK interest rate costs tend to follow.

The jump in Britain’s inflation rate can be attributed to Labour’s green agenda, which is driving up the cost of energy, and the increase in employer national insurance contributions and the national living wage, which have pushed up the expense of employment.

Further punishment for enterprise, particularly smaller firms, could be on the way, with Deputy Prime Minister Angela Rayner’s Employment Rights Bill making its way through the Commons.

If Ms Reeves does make progress on a trade deal this week – as welcome as lifting the tariff threat will be – it comes at a cost.

The proposed end to the digital services tax, which is scheduled to earn £800 million for the exchequer this year, will be handing back funds to wealthy companies such as Amazon which have contributed to the destruction of high streets across the country.